Aug 21, 2025 | Home Buyer Tips, Home Buying Tips, Home Care, Home Maintenance, Home Mortgage, Home Seller Tips, Home Selling Tips, Homebuyer Tips, Homeowner Tips, Housing Analysis, Housing Market

First-time buyers now account for 58% of agency purchase lending, and Gen Z makes up a growing 25% of those loans. But winning their business requires a fresh approach: digital-first experiences, alternative credit scoring, and tailored loan products. For mortgage lenders in Massachusetts and New Hampshire, this isn’t just theory — it’s survival. In this playbook, we’ll break down the strategies that resonate with today’s buyers and help you capture tomorrow’s market.

The share of first-time buyers is shrinking overall, and the median age of a first-time buyer has risen to 38. Gen Z, though small in numbers (just 3% of all buyers), is punching above its weight by embracing FHA loans, family assistance, and affordable markets. Millennials, meanwhile, are stalling under the weight of rising home prices and stagnant incomes.

For lenders, the question isn’t if you should adapt to these buyers — it’s how quickly you can.

Offer FHA and Low Down Payment Options

Younger buyers are strapped with student loans and high living costs, making traditional 20% down payments unrealistic. FHA and other low down payment products have become lifelines. Highlight these programs in your outreach, and make sure your application process clearly explains requirements, insurance costs, and benefits.

Playbook Tip: Don’t just advertise “low down payment loans.” Provide easy-to-digest comparisons that show real monthly savings.

Embrace Digital-First Lending

Gen Z has grown up with apps, mobile banking, and online shopping. They expect the same ease when applying for a mortgage. That means:

- Online application portals that track progress in real time

- Virtual closings and e-signatures

- Mobile-friendly communication (texts > voicemails)

Playbook Tip: Invest in user experience. A clunky or outdated digital system is the fastest way to lose a young buyer’s trust.

Expand Credit Access with VantageScore 4.0

Traditional FICO models miss many younger buyers who have limited credit histories. The adoption of VantageScore 4.0 by Fannie and Freddie now allows rental, utility, and telecom payments to count toward creditworthiness.

Playbook Tip: Educate buyers on how their rent payments or phone bills can help build eligibility. Position your firm as the one that “opens doors” others might close.

Focus on Affordable Regions

Gen Z and millennials are avoiding expensive coastal metros and targeting affordable hubs. While Boston remains out of reach for many, smaller Massachusetts and New Hampshire markets — from Worcester to Nashua — are becoming hotspots.

Playbook Tip: Tailor marketing to highlight affordable entry points in your lending region. Show young buyers where their money stretches further.

Educate, Don’t Intimidate

Younger buyers are financially cautious. They want transparency, not jargon. Offering educational content — from down payment savings tips to debt reduction strategies — helps position lenders as trusted partners rather than gatekeepers.

Playbook Tip: Host webinars, create short guides, or even offer 1:1 consultations specifically for first-time buyers.

The Lender Recommendations at a Glance

Here’s your quick reference guide to reaching tomorrow’s homeowners:

- Emphasize low down payment / FHA products

- Highlight digital ease with online applications and virtual closings

- Promote new credit scoring models (VantageScore 4.0, rent/utility history)

- Segment geographically toward affordable regions

- Provide educational resources to build trust and financial readiness

The next generation of homebuyers is smaller, more cautious, and more demanding of digital convenience — but they’re also motivated. By rethinking your lending approach now, you can not only capture Gen Z and millennial buyers but also build loyalty that carries into their next purchase.

At The Law Office of David R. Rocheford, Jr., P.C., we partner with buyers and lenders across Massachusetts and New Hampshire to ensure every closing is smooth, compliant, and future-ready.

Let’s talk about how we can support your lending process and protect your transactions — schedule a consultation today

Providing title, escrow, closing and settlement services to clients throughout Massachusetts and New Hampshire

“I would highly recommend David as a closing attorney. I have known David and have been using his office for many years. David’s professionalism when dealing with me, my closing department and most especially my clients has been always exemplary.”

SENIOR LOAN OFFICER, SHAMROCK FINANCIAL SERVICES

“The Law Office of Attorney David R. Rocheford, Jr. is by far the most exceptional real estate law office that I have had the pleasure of working with. The professionalism is by far second to none.”

SENIOR LOAN OFFICER, SALEM FIVE MORTGAGE SERVICES

“Attorney David Rocheford has provided settlement and title services for me and Greenpark Mortgage several years. He has assisted all of my clients, including my family and friends with mortgage closings. Always providing excellent service. Reliable and trustworthy!”

Aug 21, 2025 | Home Buyer Tips, Home Buying Tips, Home Care Tips, Home Closings, Home Tips, Homeowner Tips, Housing Analysis, Mortgage, Uncategorized

They may represent just 3% of all buyers, but Gen Z is determined to change the game. Armed with FHA loans, side hustles, and family support, these resourceful buyers are targeting affordable regions — not Boston, but places like Grand Rapids and Salt Lake City. In New Hampshire and Massachusetts, they’re hunting for opportunity while carrying average personal debt over $94,000. Here’s how this rising generation is entering the market, and what lenders should know to meet them where they are.

Gen Z came of age during economic upheaval — the 2008 housing crash was their childhood backdrop, and the COVID-19 pandemic shaped their early adulthood. They’ve watched older millennials struggle with student debt and delayed homeownership. That history has made them cautious, debt-averse, and surprisingly strategic in their approach to buying.

Unlike previous generations, Gen Z doesn’t expect homeownership to happen overnight. They’re willing to rent longer, work side hustles, and lean on family support if it helps them break into the market when the timing is right.

Affordability is the single biggest obstacle standing in their way.

- Average debt load: over $94,000 per young adult.

- Median household income growth: stagnant compared to housing costs.

- Entry-level homes: scarce, especially in high-cost regions like Greater Boston.

In short, the math doesn’t always work. But that hasn’t stopped Gen Z from getting creative.

How They’re Making It Work

FHA and Low Down Payment Loans

With cash savings limited, FHA loans and other low down payment programs are Gen Z’s go-to tool. These options allow them to enter the market sooner, even if it means paying mortgage insurance.

Side Hustles and Multiple Income Streams

From freelance work to online businesses, Gen Z isn’t afraid to diversify income to qualify for a mortgage. Lenders who recognize alternative income streams — and can explain how to document them properly — gain a clear edge.

Family Support and Gifts of Equity

Parents and grandparents are playing a larger role, either through co-signing, down payment assistance, or equity transfers. These transactions often involve extra legal steps, which is where experienced closing attorneys keep everything compliant.

Targeting Affordable Regions

Gen Z is skipping the Boston condo market and looking north and west — from New Hampshire’s suburbs to smaller Massachusetts cities like Worcester. They want affordability, community, and remote-work flexibility more than urban prestige.

For lenders, winning Gen Z business means more than just offering a loan — it’s about meeting them on their terms.

- Be Digital-First: Mobile-friendly applications, virtual closings, and real-time status updates are table stakes.

- Expand Credit Access: Use VantageScore 4.0 and consider rent or utility payment histories for applicants with thin credit files.

- Educate and Simplify: Break down loan terms in plain English, offer first-time buyer workshops, and demystify the process.

- Focus on Entry Markets: Market lending products in regions where Gen Z is actually shopping, not just where the big headlines are.

Quick Lender Recommendations

- Highlight FHA and low down payment products

- Accept and explain alternative income sources

- Emphasize digital lending tools (portals, e-signatures, mobile updates)

- Promote credit-building strategies tied to VantageScore 4.0

- Offer first-time buyer education as part of your brand

Gen Z may be small in numbers today, but their determination is reshaping tomorrow’s market. They are resourceful, cautious, and fiercely committed to finding a way into homeownership — even when the odds seem stacked against them. For lenders, attorneys, and real estate professionals in Massachusetts and New Hampshire, understanding this generation isn’t optional. It’s the key to staying relevant.

At The Law Office of David R. Rocheford, Jr., P.C., we work alongside buyers, sellers, and lenders to ensure every deal — whether fueled by an FHA loan, family support, or creative structuring — is handled smoothly and compliantly.

Want to better understand the next wave of homebuyers? Contact us today

Providing title, escrow, closing and settlement services to clients throughout Massachusetts and New Hampshire

“I would highly recommend David as a closing attorney. I have known David and have been using his office for many years. David’s professionalism when dealing with me, my closing department and most especially my clients has been always exemplary.”

SENIOR LOAN OFFICER, SHAMROCK FINANCIAL SERVICES

“The Law Office of Attorney David R. Rocheford, Jr. is by far the most exceptional real estate law office that I have had the pleasure of working with. The professionalism is by far second to none.”

SENIOR LOAN OFFICER, SALEM FIVE MORTGAGE SERVICES

“Attorney David Rocheford has provided settlement and title services for me and Greenpark Mortgage several years. He has assisted all of my clients, including my family and friends with mortgage closings. Always providing excellent service. Reliable and trustworthy!”

Jun 19, 2025 | Around The Home, Around The Hoome, Artificial intelligence, Buying Real Estate, Chapter 7 Bankruptcy, Consumer Tips, Credit Scoring, Fair Housing, Federal Reserve, FHFA, Financial Crisis, Financial Fraud, Financial Reports, Foreclosure, Happy Thanksgiving, Holidays, Home Building Tips, Home Buyer Tips, Home Buying Tips, Home Care, Home Care Tips, Home Closings, Home Decorating, Home Financing Tips, Home Maintenance, Home Mortgage, Home Mortgage Tips, Home Seller Tips, Home Selling Tips, Home Tips, Home Values, Homebuyer Tips, Homeowner Tips, Housing Analysis, Housing Market, Interesting Stuff, Investment Properties, Legislation, Market Outlook, Mortagage Tips, Mortgage, Mortgage Guidelines, Mortgage Lenders, Mortgage Rates, Mortgage Tips, mortgage-rates-whats-ahead-september-17-2012, News, Organization Tips, Personal Finance, Probate Law, Rankings, Real Estate, Real Estate Agent Information, Real Estate Definitions, Real Estate Tips, Real Estate Trends, Realtors, Selling Real Estate, Selling Your Home, Short Sales, Statistics, Success, Taxes, The Economy, Title Insurance

Whether you’re buying with cash, investing from abroad, transferring property to a family member, or just trying to close without a headache, you’ll want to know what can trigger federal scrutiny — and how to stay off the radar.

From flagged wire transfers and shell companies to gift-of-equity sales and land near military zones, this isn’t your average title-and-keys situation.

It’s real estate with a side of national security, tax enforcement, and financial crime prevention.

Is Big Brother Watching Your Home Sale?

What Buyers and Sellers Should Know About Federal Oversight

You’re Not Paranoid — They Might Actually Be Watching

What you didn’t know on how federal agencies keep tabs on select real estate transactions.

Your Closing Packet Could Be a Federal File

How Your Paper Trail Might Raise Red Flags — And What You Can Do About It

What the FBI, IRS, and Homeland Security

Could See in Your Closing Docs

We’re unpacking what agencies might spot inside your deal’s fine print.

Caught in the Crosshairs? What Triggers Federal Interest in Your Home Sale

The Top Red Flags That Could Invite a Closer Look from Washington

Cash, LLCs, or Land Near a Base? You Might Just Be a Target

The warning signs that put your deal on the government’s radar — and how to stay clear.

Follow the Money: How the IRS Tracks Financial Crimes Through Real Estate

From Unreported Income to Shell Game Schemes

— What IRS-CI Is Looking For

Your Closing Could Be an Audit Trigger — Here’s How the IRS Sees It

Explore the patterns, documents, and loopholes that turn ordinary deals into criminal cases.

Providing title, escrow, closing and settlement services to clients throughout Massachusetts and New Hampshire

“As a realtor, the Rocheford team went above and beyond to make sure my client was not only protected from a legal standpoint but also operated in a timely manner to execute the sale of my client’s dream home.

Thank you for the great experience for myself and my client! Looking forward to our next deal together!”

Realtor®

“I don’t usually use attorneys that often. But if an attorney is needed, I couldn’t recommend this law office enough. I always pride myself on responding quickly to emails and calls, but I was in awe of how fast paralegal Robert Heckman would respond to us. We sold our house a couple months ago and then did a two-part land swap with neighbors and my folks, and both transactions were seamless, including coming in to sign paperwork.

In short, if you need a law office that is responsive and attentive to detail, definitely consider them!”

Leominster, MA

“Excellent, conscientious and professional.

The communication throughout our Real Estate transaction was better than expected. We thought the fee to be very reasonable considering the work accomplished on our behalf. The law office handled the entire closing without us having to be in attendance….as we requested. I have had experience with very competent lawyers and law firms as the result of my previous profession. I would place this law office right up there among the best in their real estate field of expertise and surprisingly at very reasonable and affordable rates/fees.”

Buzzards Bay, MA

Jun 19, 2024 | Housing Analysis, Real Estate

| By Zachary Greenfield, Esq., Underwriting Counsel, Stewart Title Insurance Company

According to a recent study by consulting and actuarial group Milliman for the American Land Title Association, from 2013 to 2022, title insurance underwriters handled more than 200,000 claims and incurred approximately $4.4 billion dollars in claims losses and related expenses, 21% of which resulted from fraud and forgery claims. While the average claim cost for matters not involving fraud or forgery was $26,328, the average cost of each fraud or forgery claim was approximately $143,000.

The study grouped claims into 11 categories. The top four categories were as follows:

| Category |

Description |

Percent of all claims |

| Basic Risk |

fraud, forgery, undisclosed heirs, marital rights, competency, etc. |

24% |

| Special Risks |

mechanics’ liens, subordination of prior risks, underwritten risks, etc. |

21% |

| Escrow and Closing Procedures |

improper instructions, improper payments, failure to make a payment, failure to complete post-closing duties, etc. |

13.70% |

| Examination and Opinion irregularities |

irregular omissions, unforeseen risks, etc. |

11.90% |

The remaining categories included “apparent non-covered claims” (8%); “endorsement, title plan, search and abstract claims” (7.8%); “taxes and special assessment claims” (7%); “survey-inspection/description matters” (5.2%); “typing or policy review” (0.9%); “stakeholder and interpleader cases” (0.3%); and “disputed procedure” (0.2%), including matters such as foreclosures and government forfeitures.

Notably, the study found that in addition to being the most expensive type of claim, the frequency of fraud and forgery claims is on the rise. Whereas those claims represented 19% of all basic claims from 2013 to 2020, that figure rose to a staggering 44% in 2022. It is therefore now more important than ever to be on the lookout for potential title fraud. Your Stewart underwriters are always available to review any situations that you think might involve fraud or forgery. In this context, we urge you to follow the old adage, “if you see something, say something.” To view the full study, follow this link: Recent Study – Fraud & Forgery Link |

Jun 19, 2024 | Housing Analysis, Real Estate

By Mark A. Jones, Assoc. Senior Underwriting Counsel, Stewart Title Insurance Company

Whenever reviewing title examinations, when we see a traditional recorded mortgage, we all know the process of getting the mortgage released of record. The payoff is ordered, funds are collected at closing, the funds are

mailed or wired to the lender, and the lender then sends the release (hopefully) to the Registry of Deeds for recording. In contrast, an equitable mortgage is not “recorded” at the Registry of Deeds. An equitable mortgage is an inchoate lien, similar to an estate tax lien, that needs to be identified by a title examiner or attorney looking at the registry and probate records. An equitable mortgage typically arises when a divorce agreement and/or a judgment divides the marital assets, leaving one spouse the owner of real estate, but obligates the other spouse to pay a certain sum of money as part of the asset division. As the name suggests, the equitable mortgage is an equitable concept whereby if one party doesn’t satisfy their obligations, the other party’s assets are encumbered by the unsatisfied obligations. The following are some typical examples of situations where an equitable mortgage might arise and what would be required to insure.

Fact pattern 1: Divorce Agreement states Husband shall convey property to Wife and the agreement provides no payment of any funds by wife to the Husband.

Curative action: None. No equitable mortgage has been created as Wife has no financial obligation to the Husband. A conveyance by the Husband to the Wife will release his interest.

Fact pattern 2: Divorce Agreement states Husband and Wife shall list the property for sale and split the proceeds with the Wife getting 60% of the proceeds and Husband gets 40% of the proceeds. Both signed a deed for consideration to a third party buyer who is now selling.

Curative action: None. Both parties to the divorce have signed a deed for consideration and there is no need to go behind the transaction to determine if the parties received the pro rata share.

Fact pattern 3: Divorce Agreement states Wife shall convey the property to the Husband and Husband shall pay Wife $50,000. Wife conveys property to Husband for $1.00. No evidence of payment is filed in the probate or the Registry of Deeds. Five years later Husband goes to sell the property.

Curative action: As the record title fails to disclose evidence that the Husband’s financial obligation to pay the Wife the $50,000, the Wife may have an equitable mortgage encumbering the title. In order to insure we would require record title evidence of payment or a release from the Wife. Record title evidence can be satisfied by filing evidence of satisfaction of payment with the probate court in the divorce proceeding or by recording satisfactory documents with the Registry of Deeds.

Fact pattern 4: Divorce Agreement states Wife shall convey the property to the Husband and Husband shall pay Wife $50,000. Wife conveys property to Husband for $1.00. No evidence of payment is filed in the probate or the Registry of Deeds. Thirty-Five years later Husband goes to sell.

Curative action: Likely none, but check with an underwriter. Barring any extraordinary circumstances, we would generally not require evidence of payment or release from the wife. Although the traditional mortgage expiration statute (Mass Legislature Chapter 260, Section 33) of 35 years doesn’t specifically apply to an equitable mortgage, as there is no actual recorded mortgage, enough time has passed since the divorce that we would likely be comfortable insuring the property in this situation.

The above fact patterns are examples of common situations we see with divorce agreements. When reviewing a title with a divorce in the chain an Attorney should always be aware of any potential equitable mortgages that may arise. To add to the confusion, we often see situations where the agreement and/or judgment outlines the division of the property and then the parties do something completely different. Most divorce situations require a case by case analysis.

Jan 10, 2023 | Financial Reports, Housing Analysis, Real Estate

January 10, 2023 – Since the beginning of the pandemic, the housing market has experienced a series of highs and lows. The housing market was already strong prior to 2020, but the pandemic redefined the role of a home, creating a surge in demand which, coupled with record-low mortgage rates and limited housing supply, powered the housing market to multiple records during this unprecedented time – the fastest annual house price appreciation, the lowest days on market in the history of record-keeping, and a near-record annualized pace of sales. But, as mortgage rates increased alongside the Federal Reserve’s monetary policy tightening, the housing market froze up in the second half of 2022, with both buyers and sellers withdrawing from the market. Will the freeze continue well into 2023 or will the housing market begin to thaw?

demand which, coupled with record-low mortgage rates and limited housing supply, powered the housing market to multiple records during this unprecedented time – the fastest annual house price appreciation, the lowest days on market in the history of record-keeping, and a near-record annualized pace of sales. But, as mortgage rates increased alongside the Federal Reserve’s monetary policy tightening, the housing market froze up in the second half of 2022, with both buyers and sellers withdrawing from the market. Will the freeze continue well into 2023 or will the housing market begin to thaw?

“The main trend to watch is whether mortgage rates will go any higher and, if so, by how much.”

Three Scenarios for the 2023 Housing Market

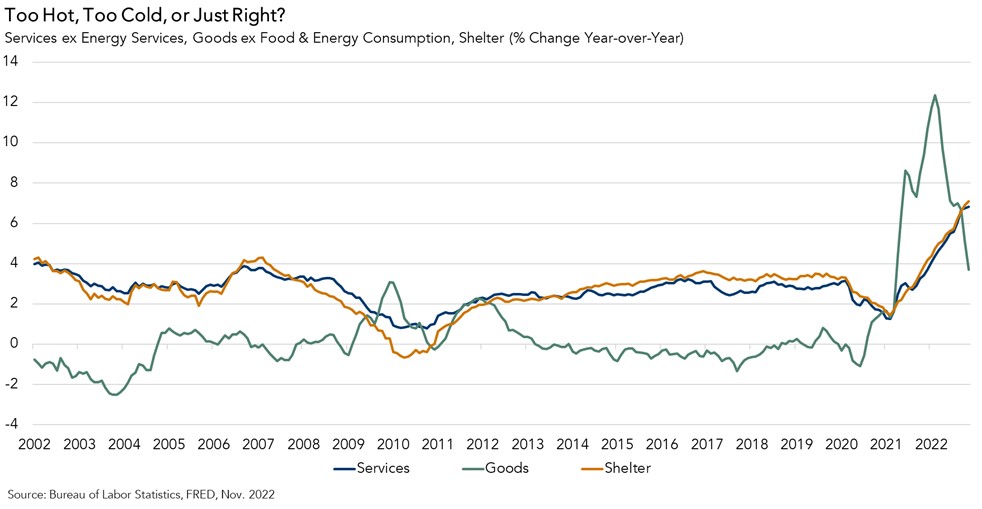

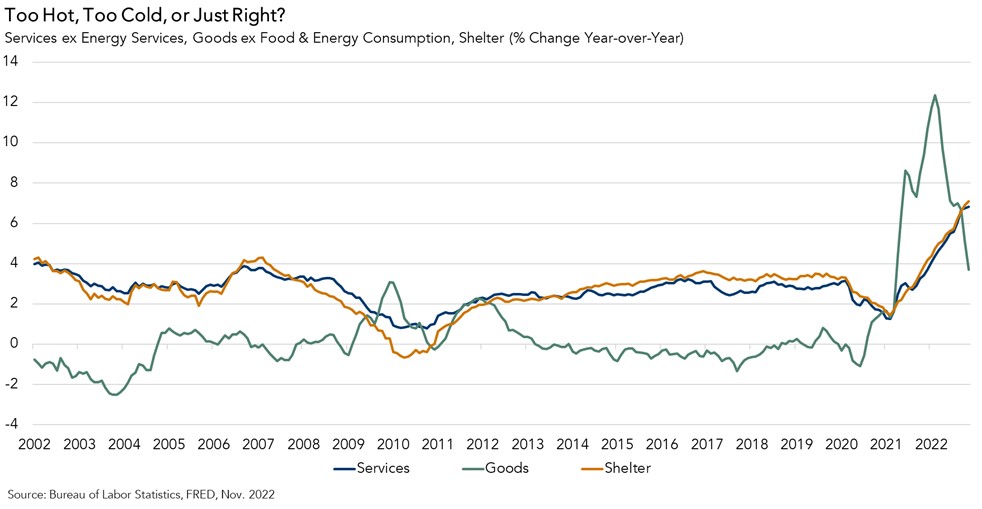

The popular 30-year, fixed mortgage rate is loosely benchmarked to the 10-year Treasury note, and when investors are concerned about inflation, their appetite for buying bonds diminishes, which puts upward pressure on bond yields and, therefore, mortgage rates. The risk is that rates will continue to increase until we get sustained evidence that inflation is receding. So, the outlook for the housing market is largely dependent on the path of inflation. Below are three possible paths for inflation that are anchored to the Fed’s monetary tightening: the baseline case (the likely), the downside case (the bad), and the upside case (the good).

- The Likely: The Fed is focused on the dynamics of inflation in parts, and not all parts are trending in the same direction. Core goods inflation increased dramatically in 2021 due to COVID-related supply disruptions and a demand surge for goods by domestic consumers. However, that inflation surge is now quickly fading.Service sector inflation is still rising, largely due to the shelter component. Shelter is considered a service and makes up 57 percent of core services in the Consumer Price Index. By virtue of how it is measured, shelter inflation also lags observed rental and house price increases by approximately one year. Rent and price growth are now decelerating, meaning the shelter component of inflation will cool – it’s just a matter of time.Core services excluding shelter is the last component. Service providers are still struggling to find labor, their primary input. As a result, service sector wages are still growing quickly – faster than the overall rate of wage growth, which is relatively strong itself. The Fed aims to lower consumption demand by setting the federal funds rate at just the right level. The “terminal rate”— the level at which the Fed is expected to stop raising interest rates — for the baseline case is approximately 5 to 5.25 percent, based on FOMC projections. If the Fed reaches this level by mid-2023, then they will likely hold rates at that higher level for the rest of the year.

As the Fed continues to tighten monetary policy, it will put more upward pressure on Treasury bonds and, therefore, mortgage rates in the first half of the year. Higher mortgage rates negatively impact both housing demand and supply, pricing out buyers who lose purchasing power and keeping some potential sellers rate-locked in. Prices will also continue to correct and reflect the new dynamic of less demand relative to slightly more, yet still well below historically normal, levels of supply. If inflation responds as expected in 2023 and the Fed’s terminal rate target is right, mortgage rates may start to decline as inflation expectations ease. Lower house prices and modestly lower mortgage rates would give house-buying power a boost.

- The Bad: The downside scenario reflects an economy that faces stubborn or even worsening inflation, leading the Fed to raise rates beyond the 5 to 5.25 percent terminal rate. This would lead to greater monetary tightness in the market and put even more upward pressure on mortgage rates, raising the probability of a recession. Even higher mortgage rates could further freeze the housing market, prompting even more sellers to stay put than in the base case due to the rate lock-in effect and buyers being further priced out of the market. In this scenario, we will see steeper price declines from the peak, both nationally and across a greater number of markets.

- The Good: The upside case is that the Fed doesn’t even need to raise rates to the 5 to 5.25 percent terminal rate because inflation comes down faster than expected. This scenario assumes consumers choose to pull back on spending, despite still sitting on a lot of excess savings built up during the pandemic. As a result, mortgage rates may stabilize sooner than in the base case, and potential buyers and sellers would benefit from the lack of rate volatility. Prices would continue to adjust in response to higher rates, which may provide an affordability boost to potential home buyers. But, even in this scenario, the housing market will still struggle from a lack of supply. Potential sellers would still be locked into record-low mortgage rates and hesitant to sell in a higher interest-rate environment.

What Do all Three Scenarios Have in Common?

In all three cases, the housing market will continue to rebalance as prices adjust to the reality of higher mortgage rates. However, the pace of price deceleration and the decline in home sales will be more severe in the downside, higher inflation scenario. The main trend to watch is whether mortgage rates will go any higher and, if so, by how much. Once mortgage rates peak, home sales volume and price declines will stabilize. That all depends on what the Fed chooses to do in the coming months and whether inflation begins to decline.

Credit: First American Title

demand which, coupled with record-low mortgage rates and limited housing supply, powered the housing market to multiple records during this unprecedented time – the fastest annual house price appreciation, the lowest days on market in the history of record-keeping, and a near-record annualized pace of sales. But, as mortgage rates increased alongside the Federal Reserve’s monetary policy tightening, the housing market froze up in the second half of 2022, with both buyers and sellers withdrawing from the market. Will the freeze continue well into 2023 or will the housing market begin to thaw?

demand which, coupled with record-low mortgage rates and limited housing supply, powered the housing market to multiple records during this unprecedented time – the fastest annual house price appreciation, the lowest days on market in the history of record-keeping, and a near-record annualized pace of sales. But, as mortgage rates increased alongside the Federal Reserve’s monetary policy tightening, the housing market froze up in the second half of 2022, with both buyers and sellers withdrawing from the market. Will the freeze continue well into 2023 or will the housing market begin to thaw?