Mar 3, 2023 | Real Estate

Multiple real estate wire fraud stories have made national news in the past few years. As these types of incidents continue to make headlines and criminals gain a better understanding of the processes and trusted institutions within the real estate sector, it’s more important than ever for real estate professionals and businesses of all sizes to understand cybersecurity threats.

.

Why is the real estate industry a target for criminals?

.

Feb 16, 2023 | Real Estate Agent Information

The refrigerator salesman has zero understanding of social media, yet his sales outdistance those of colleagues. The secret to his success? Ice cream. He hands a gallon to everyone willing to listen to his sales pitch. Who’s going to drive around comparison shopping for other brands with a carton of ice cream in the car? For this savvy professional, his sweet gift proves an unbeatable sales tool every time. What’s to be learned from him since you’re pitching condos and single family abodes, not appliances? That social media driven tools are terrific, but human nature trumps all when it comes to relating to people and proving that you’re the only person they need to make their home-ownership dreams come true. Make your marketing message the real deal by adopting some (or all) of these 10 tips.

The refrigerator salesman has zero understanding of social media, yet his sales outdistance those of colleagues. The secret to his success? Ice cream. He hands a gallon to everyone willing to listen to his sales pitch. Who’s going to drive around comparison shopping for other brands with a carton of ice cream in the car? For this savvy professional, his sweet gift proves an unbeatable sales tool every time. What’s to be learned from him since you’re pitching condos and single family abodes, not appliances? That social media driven tools are terrific, but human nature trumps all when it comes to relating to people and proving that you’re the only person they need to make their home-ownership dreams come true. Make your marketing message the real deal by adopting some (or all) of these 10 tips.

1. Tell the Story

Every house sale has a story behind it: the couple leaving a condo because they can finally afford a house, retirees relocating to Florida at last or a single career woman savvy enough to buy rather than rent. No matter which side of the deal you’re on – representing the buyer or the seller – taking time to learn the story behind the sale can’t help but be an asset down the road.

2. Up Your SQ (Schmooze Quotient)

Prying information from prospects early in a relationship is critical so you don’t waste time romancing people who have no business house shopping or those who couldn’t get financing if their lives depended on it. Ask probing questions: Why a client wants to buy or sell and what they can afford. Use your SQ to sleuth out expectations only learned when the chat is casual and off-the-cuff. For example: he has a philosophy PhD; she’s a lawyer. They’re both convinced they can rehab distressed houses on their own but it was never mentioned. Think of yourself as a detective looking for clues.

3. Newbie or Seasoned Vet?

Learn ASAP whether you’re dealing with a seasoned home buyer or a newbie to ascertain how much hand-holding you can expect to do over the course of your relationship. Seasoned home buyers or sellers have been there, done that. New kids on the block could require as much patience as do your own teens, so if you’re impatient by nature or have multiple balls in the air, learning about client real estate history saves time for everyone.

4. Speaking of Time…

Once you establish bonds by sharing the location of your community’s best dry cleaner or offer to put prospects in touch with your hair stylist – nail down a timeline. Finding out when a buyer or seller needs to seal the deal helps you ID the quintessential window shopper and eliminates houses or condos that won’t be ready to accommodate out-of-towners who have already booked a moving van. By the way, this is a great time to find out if you’ve got a fickle prospect on your hands. Ask if a client is already working with a real estate professional. Look ‘em in the eye when you pose the question.

5. What’s Your Message?

Sure, your real estate company has beaucoup marketing messages emblazoned across signage, business cards, mugs and more, but what’s your personal message? Think about it. Your sales philosophy, approach and techniques are unique. Bringing home-baked muffins to a first client meeting may be the ice breaker you’re comfortable using. Of course, if you had no idea muffins came from places other than storefront bakeries, you may wish to bring bottled water, instead.

6. Want to Get Promoted?

T-shirts? Check. Pens? You bet. Calendars? They even have your face on them. But before you sink a bundle into personalized materials, remember that research proves such items usually go to “junk drawers” to die alongside your competitors’ giveaways. It’s okay to invest in a premium that doesn’t break your budget, but do some market research first. Find out what people would actually use by surveying friends and relatives. Ask for opinions and you’ll get them.

7. Everyone Wants Approval

Pre-approved customers are near and dear to the hearts of real estate professionals because only serious prospects are this efficient. As a result, they also know their spending limits and define their own time parameters, big blessings for anyone who has suffered a string of sales that involved getting financing after a client has fallen in love. Does this mean you should give folks who aren’t pre-qualified to the office newbie? Never. That’s why you have mortgage lending resources on your speed dial.

8. Think Like a Social Scientist

Remember the name Maslow and your teacher’s lecture on “man’s basic needs”? Time to put his theory into your real estate practice. Maslow’s pyramid explains that basics like food, shelter, sleep, sex and safety drive human behavior long before a person seeks affection, approval and acceptance. You’re selling shelter and safety, not a house or a condo. If a sale is successful, you give clients access to food, sex and sleep.

9. Tool Around Scientists don’t give up.

They keep trying new ideas until they’re successful. Need we remind you that as unique as your clients may be, you’re equally unique? So don’t be hesitant to audition what works for competitors or colleagues to see what suits your sales style. One real estate professional says his website – not the firm website – draws traffic. Another uses property blasts to give clients “exclusives” on new listings. Try everything that doesn’t require breaking the law. Dump what doesn’t work and keep the rest.

10. Don’t Phone It In

Develop trademark kindnesses (those muffins), be effusive about thanking customers, remember birthdays and kids’ names – and for heavens’ sake, read at least one client blog post if they send you a link! Importantly, take passion checks. If you’re phoning it in, how much success can you expect? Need a break or vacation? Take the honeymoon first and rediscover your love. In the end, the most powerful message you send is your enthusiasm for your career!

Jan 27, 2023 | Financial Reports, Real Estate

Photo by geralt on Pixabay

The current real estate market is not showing a lot of signs of life. That’s not to say it isn’t experiencing its own moment of growth and development, but the recent sell-off of entire properties seems like an abrupt halt to activity. Maybe it’s the fact that new buildings are being built all day long and old properties must be getting through the hiccup before they can be officially listed again? Or maybe it’s just our constant need to know what’s going on? Regardless, prospective homebuyers should take heart in the fact that most properties that have been listed recently did not have foreclosures on them! In other words, there are still plenty of properties for sale in the current market that haven’t been sold yet.

What’s really going on with the market?

Inventory levels in the market are still pretty high, so far that it’s hard to tell how the transition to a new model will progress. There’s no telling how quickly the tech transition will occur, and no one knows when a new model will actually be “installed.” So, there’s still no official figure for how much inventory there will be. Some experts believe it will reach as high as 50% of office space in hotels and casinos. While that number includes land and building assets, it does not include furnishings, mechanical and electrical items, or commodities such as copper, gold, or silver. Real estate brokers and investors should be prepared to absorb this inventory at their own expense.

Interest in new construction

Construction continues to be a prominent interest of many homebuyers. There are still a large number of empty units in many city blocks, and when new construction begins, it’s expected to be quite a bit higher than the average price of existing homes. It’s not just the amount of new construction that’s attracting interest, but also the level ofConstruction continues to be a prominent interest of many homebuyers. There are still a large number of empty units in many city blocks, and when new construction begins, it’s expected to be quite a bit higher than the average price of existing homes. It’s not just the amount of new construction that’s attracting interest, but also the level of interest from the general home buyer community. If enough people are interested in new construction, it can easily spark interest from other homebuyers as well.

Homes that aren’t on the market yet

When a home isn’t on the market yet, it’s typically because it’s being worked on or in storage. The owners can’t get it ready for market, so they’re waiting for a time when they can list it. In many cases, that time will be in the fall. If you have a home listed, it’s best to be ready with a strong show of proof that you can match the other properties on the block. If the other properties on the block have been listed for a while, you may be able to negotiate a better price.

Real estate agents who can’t sell

If you’re able to find a good real estate agent, you’re in luck. Unfortunately, most of them probably have a hard time finding work. In many cities, the vast majority of real estate associations have no formal training in marketing or property management. At best, they have a few years of experience managing unsold inventory and a general knowledge about how to negotiate with tenants. At worst, many of them don’t even live in the city they’re in! If you have to drive to many cities to find a good real estate agent, you might as well find a new profession. Many homebuyers turn to Realtors Service and Realtor.com to find good local real estate agents. These websites estimate the cost of hiring a real estate professional at various stages of the ownership process. If you’re in a tough spot, you can always email any of our team members to get a competitive price on a competitive job.

Lack of inventory

Many homebuyers worry about the lack of inventory in their area. When a home is listed for a long time, it’s pretty evident that people are going to want it. When there aren’t any homes left to buy, there’s a good chance that you’ll be the one left to sell the home. If you don’t have any inventory to sell, there’s nothing to stop you from living in the home for years to come. You can still take advantage of some of the favorable interest rates on unsold inventory and negotiate a lower price on an unsold home. It’s important to keep your eye on the prize, though. If you don’t have any inventory to sell, you can still take advantage of some of the favorable interest rates on unsold inventory and negotiate a lower price on an unsold home. It’s important to keep your eye on the prize, though. If you don’t have any inventory to sell, you can still take advantage of some of the favorable interest rates on unsold inventory and negotiate a lower price on an unsold home. It’s important to keep your eye on the prize, though. If you don’t have any inventory to sell, you can still take advantage of some of the favorable interest rates on unsold inventory and negotiate a lower price on an unsold home. It’s important to keep your eye on the prize, though. If you don’t have any inventory to sell, you can still take advantage of some of the favorable interest rates on unsold inventory and negotiate a lower price on an unsold home. It’s important to keep your eye on the prize, though. If you don’t have any inventory to sell, you can still take advantage of some of the favorable interest rates on unsold inventory and negotiate a lower price on an unsold home. It’s important to keep your eye on the prize, though. If you don’t have any inventory to sell, you can still take advantage of some of the favorable interest rates on unsold inventory and negotiate a lower price on an unsold home. It’s important to keep your eye on the prize, though. If you don’t have any inventory to sell, you can still take advantage of some of the favorable interest rates on unsold inventory and negotiate a lower price on an unsold home. It’s important to keep your eye on the prize, though. If you don’t have any inventory to sell, you can still take advantage of some of the favorable interest rates on unsold inventory and negotiate a lower price on an unsold home. It’s important to keep your eye on the prize, though. If you don’t have any inventory to sell, you can still take advantage of some of the favorable interest rates on unsold inventory and negotiate a lower price on an unsold home. It’s important to keep your eye on the prize, though. If you don’t have any inventory to sell, you can still take advantage of some of the favorable interest rates on unsold inventory and negotiate a lower price on an unsold home. It’s important to keep your eye on the prize, though. If you don’t have any inventory to sell, you can still take advantage of some of the favorable interest rates on unsold inventory and negotiate a lower price on an unsold home. It’s important to keep your eye on the prize, though. If you don’t have any inventory to sell, you can still take advantage of some of the favorable interest rates on unsold inventory and negotiate a lower price on an unsold home. It’s important to keep your eye on the prize, though. If you don’t have any inventory to sell, you can still take advantage of some of the favorable interest rates on unsold inventory and negotiate a lower price on an unsold home. It’s important to keep your eye on the prize, though. If you don’t have any inventory to sell, you can still take advantage of some of the favorable interest rates on unsold inventory and negotiate a lower price on an unsold home. It’s important to keep your eye on the prize, though. If you don’t have any inventory to sell, you can still take advantage of some of the favorable interest rates on unsold inventory and negotiate a lower price on an unsold home.

Jan 10, 2023 | Financial Reports, Housing Analysis, Real Estate

January 10, 2023 – Since the beginning of the pandemic, the housing market has experienced a series of highs and lows. The housing market was already strong prior to 2020, but the pandemic redefined the role of a home, creating a surge in demand which, coupled with record-low mortgage rates and limited housing supply, powered the housing market to multiple records during this unprecedented time – the fastest annual house price appreciation, the lowest days on market in the history of record-keeping, and a near-record annualized pace of sales. But, as mortgage rates increased alongside the Federal Reserve’s monetary policy tightening, the housing market froze up in the second half of 2022, with both buyers and sellers withdrawing from the market. Will the freeze continue well into 2023 or will the housing market begin to thaw?

demand which, coupled with record-low mortgage rates and limited housing supply, powered the housing market to multiple records during this unprecedented time – the fastest annual house price appreciation, the lowest days on market in the history of record-keeping, and a near-record annualized pace of sales. But, as mortgage rates increased alongside the Federal Reserve’s monetary policy tightening, the housing market froze up in the second half of 2022, with both buyers and sellers withdrawing from the market. Will the freeze continue well into 2023 or will the housing market begin to thaw?

“The main trend to watch is whether mortgage rates will go any higher and, if so, by how much.”

Three Scenarios for the 2023 Housing Market

The popular 30-year, fixed mortgage rate is loosely benchmarked to the 10-year Treasury note, and when investors are concerned about inflation, their appetite for buying bonds diminishes, which puts upward pressure on bond yields and, therefore, mortgage rates. The risk is that rates will continue to increase until we get sustained evidence that inflation is receding. So, the outlook for the housing market is largely dependent on the path of inflation. Below are three possible paths for inflation that are anchored to the Fed’s monetary tightening: the baseline case (the likely), the downside case (the bad), and the upside case (the good).

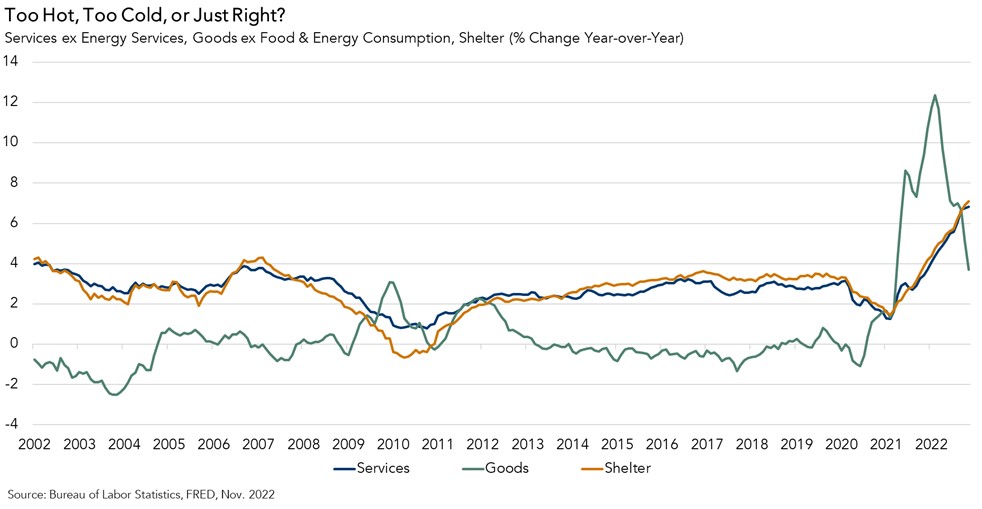

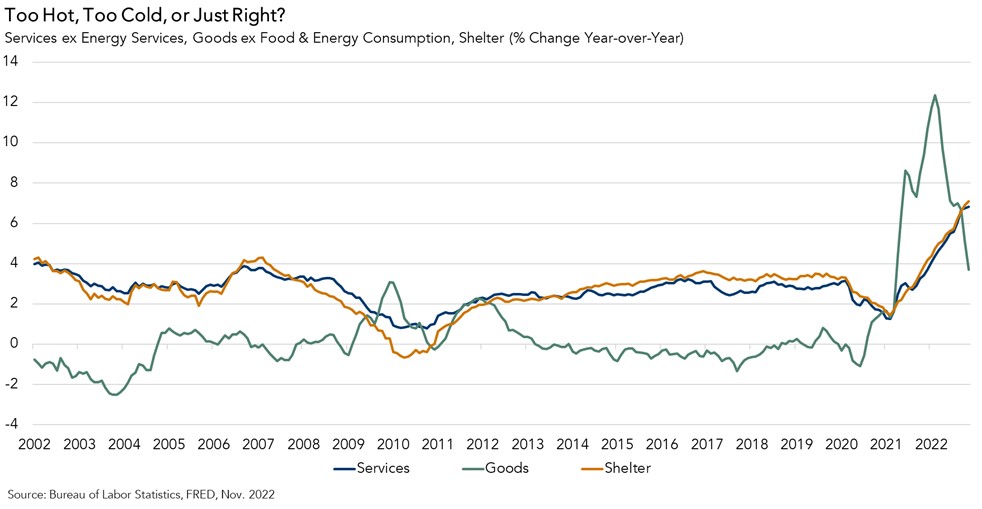

- The Likely: The Fed is focused on the dynamics of inflation in parts, and not all parts are trending in the same direction. Core goods inflation increased dramatically in 2021 due to COVID-related supply disruptions and a demand surge for goods by domestic consumers. However, that inflation surge is now quickly fading.Service sector inflation is still rising, largely due to the shelter component. Shelter is considered a service and makes up 57 percent of core services in the Consumer Price Index. By virtue of how it is measured, shelter inflation also lags observed rental and house price increases by approximately one year. Rent and price growth are now decelerating, meaning the shelter component of inflation will cool – it’s just a matter of time.Core services excluding shelter is the last component. Service providers are still struggling to find labor, their primary input. As a result, service sector wages are still growing quickly – faster than the overall rate of wage growth, which is relatively strong itself. The Fed aims to lower consumption demand by setting the federal funds rate at just the right level. The “terminal rate”— the level at which the Fed is expected to stop raising interest rates — for the baseline case is approximately 5 to 5.25 percent, based on FOMC projections. If the Fed reaches this level by mid-2023, then they will likely hold rates at that higher level for the rest of the year.

As the Fed continues to tighten monetary policy, it will put more upward pressure on Treasury bonds and, therefore, mortgage rates in the first half of the year. Higher mortgage rates negatively impact both housing demand and supply, pricing out buyers who lose purchasing power and keeping some potential sellers rate-locked in. Prices will also continue to correct and reflect the new dynamic of less demand relative to slightly more, yet still well below historically normal, levels of supply. If inflation responds as expected in 2023 and the Fed’s terminal rate target is right, mortgage rates may start to decline as inflation expectations ease. Lower house prices and modestly lower mortgage rates would give house-buying power a boost.

- The Bad: The downside scenario reflects an economy that faces stubborn or even worsening inflation, leading the Fed to raise rates beyond the 5 to 5.25 percent terminal rate. This would lead to greater monetary tightness in the market and put even more upward pressure on mortgage rates, raising the probability of a recession. Even higher mortgage rates could further freeze the housing market, prompting even more sellers to stay put than in the base case due to the rate lock-in effect and buyers being further priced out of the market. In this scenario, we will see steeper price declines from the peak, both nationally and across a greater number of markets.

- The Good: The upside case is that the Fed doesn’t even need to raise rates to the 5 to 5.25 percent terminal rate because inflation comes down faster than expected. This scenario assumes consumers choose to pull back on spending, despite still sitting on a lot of excess savings built up during the pandemic. As a result, mortgage rates may stabilize sooner than in the base case, and potential buyers and sellers would benefit from the lack of rate volatility. Prices would continue to adjust in response to higher rates, which may provide an affordability boost to potential home buyers. But, even in this scenario, the housing market will still struggle from a lack of supply. Potential sellers would still be locked into record-low mortgage rates and hesitant to sell in a higher interest-rate environment.

What Do all Three Scenarios Have in Common?

In all three cases, the housing market will continue to rebalance as prices adjust to the reality of higher mortgage rates. However, the pace of price deceleration and the decline in home sales will be more severe in the downside, higher inflation scenario. The main trend to watch is whether mortgage rates will go any higher and, if so, by how much. Once mortgage rates peak, home sales volume and price declines will stabilize. That all depends on what the Fed chooses to do in the coming months and whether inflation begins to decline.

Credit: First American Title

Jan 4, 2023 | Market Outlook, Real Estate

As a mortgage loan professional, you know that the housing market can be unpredictable and challenging at times. But despite the ups and downs, it’s important to stay positive, motivated, and active in order to succeed. Here are a few ways to stay positive and motivated in the mortgage industry:

1. Keep learning and growing. The mortgage industry is constantly changing, and it’s important to stay up to date on new laws, regulations, and best practices. Consider taking continuing education courses or joining a professional organization to stay informed and sharp. Take advantage of opportunities such as online courses or in-person seminars, and seek out mentors or colleagues who can share their knowledge and experience. You might also consider earning additional certifications or accreditations, such as the Mortgage Bankers Association’s Certified Mortgage Banker designation.

2. Network and build relationships. Building a strong network of professionals in the mortgage industry can help you stay connected and informed about new opportunities. Attend industry events and conferences, join professional groups or associations, and participate in networking events or groups within your community. Connect with colleagues and industry professionals on social media or professional networking sites, and consider joining a mentorship program or finding a mentor to help guide your career development. Collaborating with other professionals on projects or initiatives can also help you build relationships and expand your network.

associations, and participate in networking events or groups within your community. Connect with colleagues and industry professionals on social media or professional networking sites, and consider joining a mentorship program or finding a mentor to help guide your career development. Collaborating with other professionals on projects or initiatives can also help you build relationships and expand your network.

3. Stay focused on your goals. Whether you’re working towards becoming a top loan originator or building your own mortgage company, it’s important to stay focused on your long-term goals. Identify specific, achievable goals and break them down into smaller, more manageable tasks. Set deadlines for completing each task or achieving each goal, and use a planner or project management tool to track your progress and stay organized. Celebrate small victories along the way to stay motivated, and seek feedback from colleagues or mentors to ensure you’re on track.

4. Find ways to stay energized and motivated. Working in the mortgage industry can be demanding, so it’s important to find ways to stay energized and motivated. Set aside time for activities that help you relax and recharge, such as exercise, meditation, or hobbies. Take breaks throughout the day to stretch, walk around, or get some fresh air. Prioritize self-care by getting enough sleep, eating well, and taking care of your physical and mental health. Find ways to reduce stress, such as by delegating tasks or setting boundaries, and seek support from colleagues, friends, or a professional counselor if you’re feeling overwhelmed. Consider joining a support group or seeking guidance from a mentor or coach, and find ways to stay positive and motivated, such as by setting goals, finding inspiration, or focusing on your accomplishments.

5. Remember why you got into this industry in the first place. When times are tough, it’s easy to lose sight of your passion for helping people achieve the dream of homeownership. Take a moment to remind yourself of why you got into this industry in the first place and how you can make a positive difference in your clients’ lives. Reflect on what motivates you and the positive impact you can have on your clients’ lives. Remember the satisfaction you get from assisting clients in reaching their financial goals, and keep in mind the long-term rewards of your hard work, such as career advancement or the opportunity to own your own business. Find inspiration in success stories or testimonials from satisfied clients, and focus on your strengths and the value you bring to your clients and colleagues. Find ways to give back to the community, such as by volunteering or supporting local causes related to housing or financial education.

In conclusion, staying positive, motivated, and active in the mortgage industry is key to success. By staying informed, building relationships, focusing on your goals, and finding ways to recharge, you can weather any market challenges and achieve your professional dreams.

demand which, coupled with record-low mortgage rates and limited housing supply, powered the housing market to multiple records during this unprecedented time – the fastest annual house price appreciation, the lowest days on market in the history of record-keeping, and a near-record annualized pace of sales. But, as mortgage rates increased alongside the Federal Reserve’s monetary policy tightening, the housing market froze up in the second half of 2022, with both buyers and sellers withdrawing from the market. Will the freeze continue well into 2023 or will the housing market begin to thaw?

demand which, coupled with record-low mortgage rates and limited housing supply, powered the housing market to multiple records during this unprecedented time – the fastest annual house price appreciation, the lowest days on market in the history of record-keeping, and a near-record annualized pace of sales. But, as mortgage rates increased alongside the Federal Reserve’s monetary policy tightening, the housing market froze up in the second half of 2022, with both buyers and sellers withdrawing from the market. Will the freeze continue well into 2023 or will the housing market begin to thaw?

The refrigerator salesman has zero understanding of social media, yet his sales outdistance those of colleagues. The secret to his success? Ice cream. He hands a gallon to everyone willing to listen to his sales pitch. Who’s going to drive around comparison shopping for other brands with a carton of ice cream in the car? For this savvy professional, his sweet gift proves an unbeatable sales tool every time. What’s to be learned from him since you’re pitching condos and single family abodes, not appliances? That social media driven tools are terrific, but human nature trumps all when it comes to relating to people and proving that you’re the only person they need to make their home-ownership dreams come true. Make your marketing message the real deal by adopting some (or all) of these 10 tips.

The refrigerator salesman has zero understanding of social media, yet his sales outdistance those of colleagues. The secret to his success? Ice cream. He hands a gallon to everyone willing to listen to his sales pitch. Who’s going to drive around comparison shopping for other brands with a carton of ice cream in the car? For this savvy professional, his sweet gift proves an unbeatable sales tool every time. What’s to be learned from him since you’re pitching condos and single family abodes, not appliances? That social media driven tools are terrific, but human nature trumps all when it comes to relating to people and proving that you’re the only person they need to make their home-ownership dreams come true. Make your marketing message the real deal by adopting some (or all) of these 10 tips.

associations, and participate in networking events or groups within your community. Connect with colleagues and industry professionals on social media or professional networking sites, and consider joining a mentorship program or finding a mentor to help guide your career development. Collaborating with other professionals on projects or initiatives can also help you build relationships and expand your network.

associations, and participate in networking events or groups within your community. Connect with colleagues and industry professionals on social media or professional networking sites, and consider joining a mentorship program or finding a mentor to help guide your career development. Collaborating with other professionals on projects or initiatives can also help you build relationships and expand your network.