Feb 17, 2026 | Uncategorized

SUMMARY: Starting March 1, 2026, FinCEN’s Residential Real Estate Rule requires a Real Estate Report for certain non-financed residential transfers where the buyer is an entity or trust (common “cash/opaque ownership” scenarios). Real estate agents do not file the report—the closing/settlement side determines the “reporting person” using FinCEN’s reporting cascade (often the closing/settlement agent or the person who prepares the settlement statement). Expect more buyer identity/beneficial ownership questions earlier in the transaction for covered deals.

A major new federal reporting requirement is about to change certain residential real estate closings—especially the kinds of deals where ownership is purchased through an LLC or trust and the transaction is not financed through a traditional, AML-regulated lender. Beginning March 1, 2026, FinCEN (the Financial Crimes Enforcement Network, U.S. Treasury) will require a Real Estate Report to be filed for qualifying transfers.

This is designed to reduce the use of U.S. residential real estate for illicit finance by increasing transparency around who ultimately owns/controls the purchasing entity or trust in certain higher-risk, non-financed transactions.

1) Who this applies to (and who it usually doesn’t)

Typically in scope

The rule targets non-financed transfers of residential real property to a transferee entity (e.g., LLC/corporation/partnership/estate/association) or a transferee trust (most trusts and similar arrangements, with some exemptions).

Typically not in scope

A transaction is not “non-financed” (and therefore generally not reportable under this rule) if it includes credit that is:

- secured by the property, and

- extended by a financial institution that is subject to AML program requirements and SAR filing obligations.

That’s why many “normal” mortgage closings are generally outside this specific reporting rule—while all-cash, private financing, or certain lender situations can fall into the reportable bucket. FinCEN also states that financing by a lender without AML/SAR obligations is treated as non-financed for this rule (meaning it can be reportable).

2) What counts as “residential real property” here

FinCEN’s definition includes single-family homes, townhouses, condos, co-ops, and buildings designed for occupancy by 1–4 families, including certain mixed-use situations and certain land intended for construction of a 1–4 family residence.

3) What triggers a Real Estate Report

A Real Estate Report is required for a “reportable transfer,” defined as:

- a non-financed transfer

- to a transferee entity or transferee trust

- of an ownership interest in residential real property.

FinCEN’s FAQ also clarifies that a “transfer” includes not only purchases, but can include transfers for no consideration (like gifts) if they meet the rule’s criteria.

There are specific categories of transfers that are not reportable (examples include certain transfers due to death, divorce, bankruptcy, court supervision, certain no-consideration transfers to grantor/settlor trusts, 1031 qualified intermediary transfers, etc.).

4) Who files the report (this is key for agents)

Only one party is the “reporting person.” FinCEN identifies the reporting person using either:

- the reporting cascade, or

- a written designation agreement between eligible parties in the cascade.

The reporting cascade (high-level)

FinCEN’s cascade starts with:

- the person listed as the closing/settlement agent on the closing/settlement statement, then

- the person who prepares the closing/settlement statement, then additional steps if those don’t apply.

FinCEN’s filing instructions also emphasize that the reporting person is determined through the reporting cascade or a designation agreement, and that the reporting person remains responsible for complete and timely filing (even if they outsource the preparation).

Bottom line for Real Estate Agents: you are part of the transaction workflow, but the report filing responsibility is handled on the closing/settlement side (often the settlement agent/closing attorney role, depending on the transaction and how the cascade lands).

5) What information gets collected (what your entity/trust buyers will notice)

FinCEN states the reporting person must submit information sufficient to identify:

- the reporting person,

- the property,

- the transferor (seller),

- the transferee entity/trust (buyer),

- the individuals representing the transferee, and

- the beneficial owners of the transferee entity/trust.

FinCEN gives examples of beneficial owner identifying data that must be collected, including: name, date of birth, residential address, citizenship, and taxpayer identification number.

6) Timing: when reports are due (and what “March 1” really means)

FinCEN’s guidance is explicit:

- No reports are required for transfers that close prior to March 1, 2026.

- For reportable transfers, the report must be filed by the later of:

- the last day of the month following the month of closing, or

- 30 calendar days after closing.

FinCEN also notes this generally gives reporting persons about 30–60 days to file.

Reports are filed electronically through FinCEN’s BSA E-Filing System (the Residential Real Estate Rule page points filers to BSA E-Filing beginning March 1, 2026).

7) What agents should expect (without making agents “responsible”)

Even when agents are not the filer, this rule can affect your timeline and client experience in certain deals. Here’s what will realistically change for covered transactions:

- Entity/trust buyers may be asked earlier for ownership/beneficial owner information and certifications.

- There may be more back-and-forth between the buyer and the settlement team if beneficial ownership details are incomplete or unclear.

- Covered transactions may need a little more lead time so documentation doesn’t bottleneck the closing. (This is a workflow implication of the required data and filing obligation, not a new duty placed on agents.)

Practical agent takeaway: if your buyer is purchasing through an LLC or trust and isn’t using a traditional AML/SAR-regulated lender, it’s smart to flag that early to the settlement team so they can confirm whether the transfer is reportable and begin collecting what’s needed.

8) Recordkeeping (for the reporting person)

FinCEN states the reporting person must retain:

- the beneficial ownership certification from the transferee (or representative), and

any designation agreement,

for five years. FinCEN also states the reporting person is not required to retain a copy of the Real Estate Report itself.

9) A quick note on penalties (high level)

FinCEN’s FAQs focus on the reporting framework and do not lay out a simple penalty schedule on the FAQ page itself. In general, FinCEN reporting regimes are backed by civil and criminal enforcement mechanisms under federal law, which is why settlement teams are building formal intake and documentation workflows for reportable transfers.

Example secondary sources discussing civil/criminal exposure:

Providing title, escrow, closing and settlement services to clients throughout Massachusetts and New Hampshire

Feb 17, 2026 | Uncategorized

For many buyers, one of the most surprising parts of homeownership happens after the closing is complete: the sudden increase in mail related to their property.

This isn’t accidental—and it isn’t unique to any one company or offer. It’s the predictable result of how real estate ownership is recorded and shared.

A Recorded Deed Is a Public Signal

When a home purchase closes, the deed is recorded at the Registry of Deeds. This step is required to legally establish ownership, and it creates a permanent public record.

That recording does more than confirm who owns the property. It also signals, very clearly, that:

- A transaction just occurred

- A new owner is in place

- The information is finalized and searchable

From a systems perspective, a newly recorded deed is an event marker.

Public Records Are Designed to Be Accessible

Registries of deeds are built to support transparency. Lenders, municipalities, courts, and title professionals rely on immediate access to ownership data to function properly.

Because of that:

- New recordings can be observed as soon as they are filed

- Ownership changes are easy to track at scale

- No notification is required to access the information

This openness is a feature of the system—not a flaw.

Why New Owners Appear on Radars Immediately

Many private companies routinely monitor public recording data. When a new residential deed is filed, it can be flagged instantly and added to a database of recent transactions.

The result is that new homeowners often appear on mailing lists shortly after closing—not because they opted in, but because the ownership change became public.

The speed at which this happens is driven by automation, not human review.

Timing Matters More Than Identity

New homeowners aren’t targeted because of who they are. They’re targeted because of when they appear in the system.

The post-closing period is a narrow window in which:

- Ownership data is fresh

- Buyers expect follow-up documentation

- Familiarity with post-closing norms is still developing

From a behavioral standpoint, it’s a moment of high attention and low context. That timing—not vulnerability or mistake—is what makes new ownership records valuable to third parties.

This is a Structural Reality, Not a Closing Issue

The appearance of post-closing mail does not reflect a problem with the transaction itself. It does not indicate that something was missed or improperly handled.

It simply means the ownership record has been finalized and made visible.

Understanding that distinction helps separate administrative reality from perceived obligation.

Why Context Is Often Missing

Public records show that ownership changed—not what the homeowner already has, received, or understands.

Without that context, third-party outreach can feel confusing or authoritative, even when no action is required. The confusion stems from incomplete information, not from the recording process itself.

Once a deed is recorded, ownership becomes part of a broader information system. What follows is less about the homeowner—and more about how public data moves once it exists.

Understanding that framework makes it easier to evaluate post-closing communication calmly and confidently.

Want to See What These Mailers Look Like—and What to Do If You Receive One?

We’ve broken that down separately.

Download the Recorded Deed Notice, it covers:

- Common characteristics of these mailings

- Why they can feel official or urgent

- What action, if any, is actually required

If something ever raises questions, a quick check with your closing attorney can provide clarity before you respond.

Common Post-Closing Mail Homeowners Can Safely Ignore

After you buy a home, it’s normal for mail to start showing up that references your property, your mortgage, or your ownership. Some of it is legitimate. Much of it is optional. And some of it can safely be ignored.

Knowing the difference can save time, money, and unnecessary worry.

Below are some of the most common types of post-closing mail homeowners ask about—and what they generally mean.

Recorded Deed or Property Record Notices

These letters typically offer to provide copies of documents related to your ownership for a fee.

In most cases, these documents are already recorded and available directly through the Registry of Deeds. Purchasing them from a third party is optional and rarely necessary.

Many homeowners receive multiple home warranty solicitations shortly after closing.

These are not required, even if the letter references your recent purchase or implies urgency. Some warranties may be useful depending on your situation, but they are optional service contracts—not part of the closing process.

Mortgage Life Insurance Solicitations

These notices often suggest coverage tied specifically to your mortgage balance.

Mortgage life insurance is different from traditional life insurance and is not required by lenders. Whether it makes sense depends on your broader financial and insurance planning—not on the timing of the letter.

“Final Notice” or “Immediate Response Required” Mail

Mail labeled as a “final notice” frequently creates concern, especially when it arrives soon after closing.

In many cases, this language is a marketing tactic rather than a reflection of any actual deadline. The presence of urgency alone does not mean action is required.

Property Profiles, Reports, or Monitoring Services

Some mail offers property assessments, ownership monitoring, or record tracking services.

These products often rely on publicly available information and may duplicate records you already have or can access directly. Whether they provide value depends on the specific service—not on the fact that you recently closed.

Why There’s So Much Mail After Closing

The volume of post-closing mail surprises many homeowners, but it isn’t random.

Once a transaction is recorded, ownership becomes part of the public record. That visibility—combined with timing—is what drives much of the outreach homeowners receive.

A Simple Rule of Thumb

If a piece of mail:

- Requests payment

- References your deed, mortgage, or ownership

- Uses urgent language

- Arrives shortly after closing

…it’s worth pausing before responding.

Most post-closing notices are informational or optional. Very few require immediate action.

When in Doubt, Ask

If you’re unsure about something you receive after closing, reach out to one of your real estate professionals—your agent, loan officer, or closing attorney.

Our office is always available to review documents and help you determine whether something requires action or can be safely ignored.

Providing title, escrow, closing and settlement services to clients throughout Massachusetts and New Hampshire

Feb 17, 2026 | Uncategorized

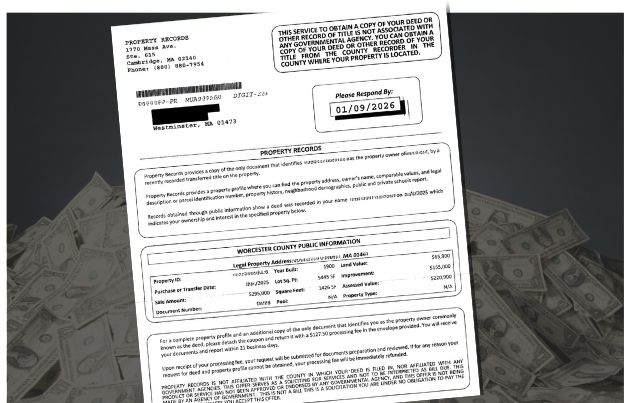

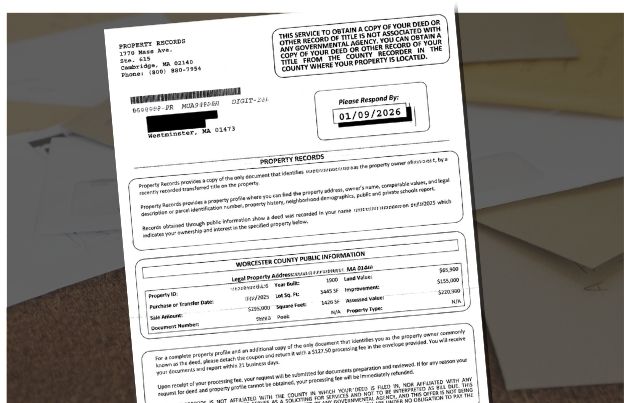

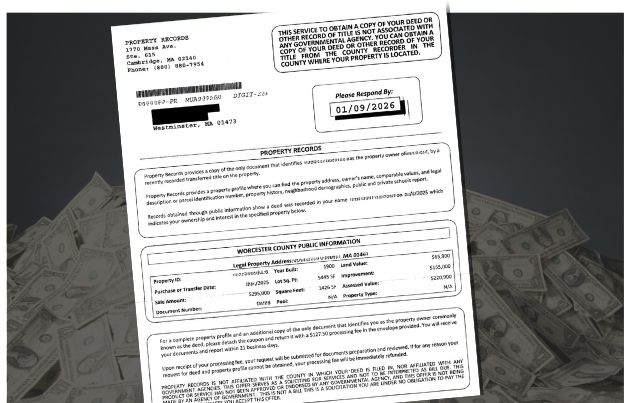

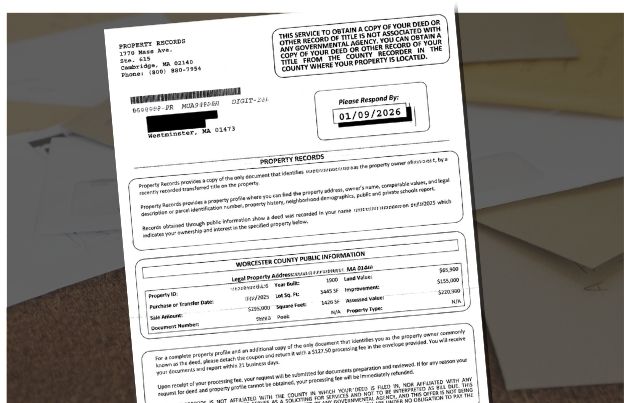

One of the most common examples we see involves letters offering to provide a copy of your recorded deed or a “property assessment report” for a substantial fee—often $125 or more. These letters are not required, not helpful, and not sent by the county or the Commonwealth of Massachusetts.

If you recently purchased a home and received something like this in the mail, here’s what you should know.

What These Letters Typically Say

These mailings are carefully designed to look important. Common features include:

- Your name and property address

- A reference to a “Recorded Deed,” “Grant Deed,” or “Property Records”

- A deadline urging you to “respond by” a certain date

- Language about verifying ownership or protecting your property

- A service or processing fee (often $125–$130)

- Fine‑print disclaimers stating the sender is not affiliated with the government

Some letters emphasize that they will obtain “the only document that identifies you as the property owner,” or that you must act quickly to secure a copy of your deed.

While these statements may sound serious, they are misleading at best.

The Truth: You Do Not Need This Service in Massachusetts

In Massachusetts:

- Your deed is already recorded at the Registry of Deeds when you buy your home

- Your ownership is legally secure without taking any further action

- You are not required to purchase a copy of your recorded deed from a private company

In fact, most buyers already receive a copy of their deed as part of the closing process. Even if you don’t have one on hand, you can easily obtain it directly from the county Registry of Deeds, usually online and for a nominal fee—often just a few dollars.

There is no legal requirement to purchase a deed copy, property profile, or assessment report from a mail‑order company after closing.

Why These Solicitations Are Misleading

Although these companies often include disclaimers stating “this is not a bill” or “not affiliated with any government agency,” those statements are typically buried in fine print.

The overall presentation is intentionally designed to:

- Mimic official government notices

- Create a false sense of urgency

- Suggest that your ownership is incomplete or at risk

- Target new homeowners, when deed recordings are public and easy to track

Importantly, these companies are simply repackaging public information that is already available to you—often at many times the actual cost.

Are These Letters Illegal?

Not necessarily—but that does not mean they are appropriate or ethical.

Many of these mailers rely on technical compliance disclaimers to avoid violating consumer protection laws. However, the Massachusetts Attorney General and consumer advocacy organizations have long warned buyers to be cautious of solicitations that:

- Use government‑style formatting

- Imply legal necessity without saying so directly

- Charge excessive fees for freely available public records

What You Should Do If You Receive One

If you receive a letter offering to obtain your deed or property records for a fee:

- Do not send payment

- Do not assume it is required or time‑sensitive

- Check the fine print—you will usually find admissions that it is a solicitation

- Contact your closing attorney if you are unsure

- If you need a deed copy, visit your local Registry of Deeds website directly

How to Get a Copy of Your Deed the Right Way

In Massachusetts, you can obtain your recorded deed by:

- Visiting your county Registry of Deeds website

- Searching by name, address, or document number

- Downloading a copy—often the same day—for a minimal recording fee

This direct route is faster, cheaper, and avoids third‑party markups entirely.

Receiving mail like this can be confusing—especially shortly after closing, when everything still feels unfamiliar. Remember:

- Your deed is already recorded

- Your ownership is already protected

- You are not missing anything—and you do not need to respond

If you ever have questions about documents you receive after your purchase, contact our office. A quick review can save you time, money, and unnecessary stress.

Want to See What These Mailers Look Like—and What to Do If You Receive One?

We’ve broken that down separately.

Download the Recorded Deed Notice, it covers:

- Common characteristics of these mailings

- Why they can feel official or urgent

- What action, if any, is actually required

If something ever raises questions, a quick check with your closing attorney can provide clarity before you respond.

Providing title, escrow, closing and settlement services to clients throughout Massachusetts and New Hampshire

Aug 21, 2025 | Home Buyer Tips, Home Buying Tips, Home Care Tips, Home Closings, Home Tips, Homeowner Tips, Housing Analysis, Mortgage, Uncategorized

They may represent just 3% of all buyers, but Gen Z is determined to change the game. Armed with FHA loans, side hustles, and family support, these resourceful buyers are targeting affordable regions — not Boston, but places like Grand Rapids and Salt Lake City. In New Hampshire and Massachusetts, they’re hunting for opportunity while carrying average personal debt over $94,000. Here’s how this rising generation is entering the market, and what lenders should know to meet them where they are.

Gen Z came of age during economic upheaval — the 2008 housing crash was their childhood backdrop, and the COVID-19 pandemic shaped their early adulthood. They’ve watched older millennials struggle with student debt and delayed homeownership. That history has made them cautious, debt-averse, and surprisingly strategic in their approach to buying.

Unlike previous generations, Gen Z doesn’t expect homeownership to happen overnight. They’re willing to rent longer, work side hustles, and lean on family support if it helps them break into the market when the timing is right.

Affordability is the single biggest obstacle standing in their way.

- Average debt load: over $94,000 per young adult.

- Median household income growth: stagnant compared to housing costs.

- Entry-level homes: scarce, especially in high-cost regions like Greater Boston.

In short, the math doesn’t always work. But that hasn’t stopped Gen Z from getting creative.

How They’re Making It Work

FHA and Low Down Payment Loans

With cash savings limited, FHA loans and other low down payment programs are Gen Z’s go-to tool. These options allow them to enter the market sooner, even if it means paying mortgage insurance.

Side Hustles and Multiple Income Streams

From freelance work to online businesses, Gen Z isn’t afraid to diversify income to qualify for a mortgage. Lenders who recognize alternative income streams — and can explain how to document them properly — gain a clear edge.

Family Support and Gifts of Equity

Parents and grandparents are playing a larger role, either through co-signing, down payment assistance, or equity transfers. These transactions often involve extra legal steps, which is where experienced closing attorneys keep everything compliant.

Targeting Affordable Regions

Gen Z is skipping the Boston condo market and looking north and west — from New Hampshire’s suburbs to smaller Massachusetts cities like Worcester. They want affordability, community, and remote-work flexibility more than urban prestige.

For lenders, winning Gen Z business means more than just offering a loan — it’s about meeting them on their terms.

- Be Digital-First: Mobile-friendly applications, virtual closings, and real-time status updates are table stakes.

- Expand Credit Access: Use VantageScore 4.0 and consider rent or utility payment histories for applicants with thin credit files.

- Educate and Simplify: Break down loan terms in plain English, offer first-time buyer workshops, and demystify the process.

- Focus on Entry Markets: Market lending products in regions where Gen Z is actually shopping, not just where the big headlines are.

Quick Lender Recommendations

- Highlight FHA and low down payment products

- Accept and explain alternative income sources

- Emphasize digital lending tools (portals, e-signatures, mobile updates)

- Promote credit-building strategies tied to VantageScore 4.0

- Offer first-time buyer education as part of your brand

Gen Z may be small in numbers today, but their determination is reshaping tomorrow’s market. They are resourceful, cautious, and fiercely committed to finding a way into homeownership — even when the odds seem stacked against them. For lenders, attorneys, and real estate professionals in Massachusetts and New Hampshire, understanding this generation isn’t optional. It’s the key to staying relevant.

At The Law Office of David R. Rocheford, Jr., P.C., we work alongside buyers, sellers, and lenders to ensure every deal — whether fueled by an FHA loan, family support, or creative structuring — is handled smoothly and compliantly.

Want to better understand the next wave of homebuyers? Contact us today

Providing title, escrow, closing and settlement services to clients throughout Massachusetts and New Hampshire

“I would highly recommend David as a closing attorney. I have known David and have been using his office for many years. David’s professionalism when dealing with me, my closing department and most especially my clients has been always exemplary.”

SENIOR LOAN OFFICER, SHAMROCK FINANCIAL SERVICES

“The Law Office of Attorney David R. Rocheford, Jr. is by far the most exceptional real estate law office that I have had the pleasure of working with. The professionalism is by far second to none.”

SENIOR LOAN OFFICER, SALEM FIVE MORTGAGE SERVICES

“Attorney David Rocheford has provided settlement and title services for me and Greenpark Mortgage several years. He has assisted all of my clients, including my family and friends with mortgage closings. Always providing excellent service. Reliable and trustworthy!”

Mar 20, 2025 | Home Buyer Tips, Home Buying Tips, Home Closings, Home Mortgage Tips, Home Seller Tips, Home Selling Tips, Home Tips, Uncategorized

AI in Real Estate: Smarter Searches, Faster Decisions

Artificial intelligence isn’t just for sci-fi movies anymore. In 2025, AI-powered tools are taking center stage in real estate. Automated property valuations, predictive analytics, and smart contract systems are helping both buyers and sellers make better-informed decisions.

Remote Closings and Digital Notarization: Convenience at Your Fingertips

Gone are the days of scrambling to find a babysitter or leaving work early to sign documents in person. With digital notarization and remote closings gaining popularity, finalizing a real estate transaction can often be done from the comfort of your couch.

Note: Remote closings are determined by state and local allowances, please defer to your Closing Attorney for any questions regarding the closing process and options.

Eco-Friendly Features in Demand

Today’s buyers are increasingly prioritizing sustainable living. Homes with solar panels, energy-efficient windows, and improved insulation are becoming top contenders. In New England’s chilly winters, these upgrades can mean real savings (and warmer toes).

Market Shifts in Coastal Areas

With rising insurance costs and climate risks, coastal properties in Massachusetts and New Hampshire may see shifts in demand. Buyers are becoming more cautious, and sellers are exploring ways to make their properties more resilient.

Tips for Navigating a Competitive Market

If you’re buying in 2025, expect some competition. Here’s how to stand out:

- Get pre-approved for your mortgage to show sellers you’re serious.

- You can choose a trusted closing attorney to work with ensuring your paperwork is airtight.

- Don’t skip the home inspection, even in a bidding war—it’s your best defense against post-closing surprises.

For sellers: Highlight energy-efficient upgrades, emphasize flexible spaces like home offices, and work with an experienced real estate attorney to ensure a smooth closing process.

Stay Ahead of the Curve

The 2025 real estate landscape may feel unpredictable, but with the right guidance, you can confidently navigate the market. Whether you’re buying or selling in Massachusetts or New Hampshire, The Law Office of David R. Rocheford, Jr. P.C. is here to help ensure your closing process goes smoothly.

Ready to take control of your closing experience? Contact us today to learn more about your rights and how we can help you through the process.

Providing title, escrow, closing and settlement services to clients throughout Massachusetts and New Hampshire

“I would highly recommend David as a closing attorney. I have known David and have been using his office for many years. David’s professionalism when dealing with me, my closing department and most especially my clients has been always exemplary.”

SENIOR LOAN OFFICER, SHAMROCK FINANCIAL SERVICES

“The Law Office of Attorney David R. Rocheford, Jr. is by far the most exceptional real estate law office that I have had the pleasure of working with. The professionalism is by far second to none.”

SENIOR LOAN OFFICER, SALEM FIVE MORTGAGE SERVICES

“Attorney David Rocheford has provided settlement and title services for me and Greenpark Mortgage several years. He has assisted all of my clients, including my family and friends with mortgage closings. Always providing excellent service. Reliable and trustworthy!”

Aug 16, 2024 | Uncategorized

By Attorney Christopher Carreira

In Massachusetts, a title examination involves searching at least 50 years of records related to a property at the Registry of Deeds, the Equity Court, the Bankruptcy Court, and even the Probate and Family Court. The purpose of this examination is to ensure that the new homeowner does not face any legal issues in the future with the documents that are publicly available to the law firm closing the transaction. An attorney typically reviews the examination for accuracy.

Title Issues

It is difficult to find someone who has not encountered a title issue at some point. These issues could include a missing mortgage discharge, a deed with typographical errors in the legal description, or a grantor clause with an incorrect name spelling. Fortunately, the Real Estate Bar Association of Massachusetts has a handbook of standards and forms to guide us in resolving these issues. This handbook contains over 200 pages of information on various title issues.

Title Insurance Companies

However, not every problem has a clear solution. It is often necessary for a title insurance company to approve a fix before any action can be taken. Title insurance companies are frequently involved when a buyer is obtaining a mortgage or when a new homeowner wants to insure the title to the property. If a problem is discovered later, lawyers may be needed to resolve the issue in court. Each title insurance company has a team of lawyers to answer questions and litigate title issues, but these lawyers do not always agree with each other.

An Example

A homeowner had two mortgages on her property. She lost her job due to illness, fell behind on her mortgage payments, and had to rely on credit cards. Six months later, she was able to return to work but needed to file a Chapter 13 bankruptcy case to eliminate her credit card debt and catch up on her mortgage payments. As part of the case, she was able to eliminate her second mortgage because the property was worth less than the amount owed on her first mortgage at the time of the bankruptcy filing.

As she got older, she decided to sell her property and downsize to a condominium. She signed a Purchase and Sales Agreement and was two weeks away from closing when the buyer’s lender’s closing attorney advised that the second mortgage needed to be paid off. She explained that the bankruptcy court had eliminated it, so it did not need to be paid off. The closing attorney called his title insurance company, which insisted that a discharge of the mortgage was necessary for marketable title. Despite numerous letters from the closing attorney, the mortgage company refused to discharge the mortgage, delaying the closing date.

The Solution

Frustrated, the homeowner called another attorney, who advised that the mortgage did not need to be discharged and that a copy of the Bankruptcy Court’s order could be recorded at the Registry of Deeds to resolve the issue. The homeowner was puzzled as to why the original attorney had not thought of this solution. Unfortunately, the original closing attorney was only able to work with one title insurance company, which was very conservative and did not allow the court order to clear the title issue. Fortunately, the homeowner suggested the buyer switch attorneys to complete the closing. The new closing attorney worked with three title insurance companies, two of which agreed with the proposed solution of recording the Bankruptcy Court order.

Frustrated, the homeowner called another attorney, who advised that the mortgage did not need to be discharged and that a copy of the Bankruptcy Court’s order could be recorded at the Registry of Deeds to resolve the issue. The homeowner was puzzled as to why the original attorney had not thought of this solution. Unfortunately, the original closing attorney was only able to work with one title insurance company, which was very conservative and did not allow the court order to clear the title issue. Fortunately, the homeowner suggested the buyer switch attorneys to complete the closing. The new closing attorney worked with three title insurance companies, two of which agreed with the proposed solution of recording the Bankruptcy Court order.

The Cost

After months of wasted time and extra money spent on mortgage payments and bills, the new buyer was finally able to move into the property. However, they had to accept a higher interest rate and payment than originally qualified for because the new closing attorney closed the transaction with one of their three title insurance companies. This situation highlights the importance of having options.

Frustrated, the homeowner called another attorney, who advised that the mortgage did not need to be discharged and that a copy of the Bankruptcy Court’s order could be recorded at the Registry of Deeds to resolve the issue. The homeowner was puzzled as to why the original attorney had not thought of this solution. Unfortunately, the original closing attorney was only able to work with one title insurance company, which was very conservative and did not allow the court order to clear the title issue. Fortunately, the homeowner suggested the buyer switch attorneys to complete the closing. The new closing attorney worked with three title insurance companies, two of which agreed with the proposed solution of recording the Bankruptcy Court order.

Frustrated, the homeowner called another attorney, who advised that the mortgage did not need to be discharged and that a copy of the Bankruptcy Court’s order could be recorded at the Registry of Deeds to resolve the issue. The homeowner was puzzled as to why the original attorney had not thought of this solution. Unfortunately, the original closing attorney was only able to work with one title insurance company, which was very conservative and did not allow the court order to clear the title issue. Fortunately, the homeowner suggested the buyer switch attorneys to complete the closing. The new closing attorney worked with three title insurance companies, two of which agreed with the proposed solution of recording the Bankruptcy Court order.