Jan 26, 2023 | Real Estate

Are you in the market for a new house? If so, you might be thinking about building your own house. It can be exciting to go through the process of building a house, as you will be in control of just about everything. On the other hand, how much is it going to cost you to build a house? You need to make sure you have an estimate before you decide to move forward with your project.

Are you in the market for a new house? If so, you might be thinking about building your own house. It can be exciting to go through the process of building a house, as you will be in control of just about everything. On the other hand, how much is it going to cost you to build a house? You need to make sure you have an estimate before you decide to move forward with your project.

What Is The Actual Cost Of Building A House?

First, it is important to go through the actual itemized list line by line. You will need to purchase land if you are interested in building a house. Then, you need to lay the foundation. The price of all of these options is going to vary depending on your location and the square footage of your foundation overall.

You will also have to go through the process of framing your house, and you will need to put a roof on your house. Then, you will need to purchase appliances, utilities, and various finishes and fixtures along the way. Remember that you will also have to apply for permits from the city.

What About Financing A New Build?

If you are building your house, you still have the option to take out a mortgage; however, you need to specify when the interest rate on your construction loan is locked in. It will be a process to finish the house, and interest rates could change during the course of the construction. The mortgage company will want to start earning interest as soon as possible, so you will need to negotiate both with the lender and the construction company to ensure you understand the terms.

You will also have to go through the same vetting process as you would for any other mortgage. You need to make sure you have favorable credit, enough income to cover your housing payments, a low debt-to-income ratio, and a sizable down payment. If you are interested in building your house, you will probably be required to put 20 percent down, but if you are willing to put more money down, you may be able to qualify for a lower interest rate.

Jan 24, 2023 | Real Estate

Are you interested in purchasing a rental property? Instead of buying a new one, you might want to convert your primary residence into a rental property, particularly if you plan on moving in the near future. At the same time, you might think it is better to sell the property and take the cash instead. Which option is best for you?

Are you interested in purchasing a rental property? Instead of buying a new one, you might want to convert your primary residence into a rental property, particularly if you plan on moving in the near future. At the same time, you might think it is better to sell the property and take the cash instead. Which option is best for you?

Potential Issues Converting Your Primary Residence To A Rental Property

If you want to convert your primary residence into a rental property, there are a few important issues to keep in mind. First, you must make sure you have lived in the home long enough to qualify for beneficial mortgage rates. Because the property is your primary residence, you probably received a lower interest rate. Check your mortgage contract and make sure you have lived in the property long enough to convert it to a rental property. You don’t want to be accused of mortgage fraud.

Also, remember that your real estate taxes might go up if you convert your primary residence into a rental property. You qualify for lower real estate taxes if you live in the home you own. Once the government realizes you no longer live there, your real estate taxes could rise.

The Benefits Of Converting It To A Rental Property

If you can navigate these issues, there are a few benefits to converting your primary residence to a rental property. For example, you will have an additional, reliable stream of passive income that you might be able to use to qualify for your next mortgage. Furthermore, the amount of money you may charge for rent could go up over time.

You can hold the property for a longer amount of time, so you will enjoy additional capital appreciation. That means if you wait longer to sell the property, you should get more money for it.

Think About Your Choices Carefully

You should think carefully about whether you want to sell your primary residence or convert it to a rental property. Each option has its benefits and drawbacks, and you need to think about which choice is best for your needs. Do not hesitate to reach out to an expert who can help you.

Jan 20, 2023 | Real Estate

There is a good chance you have heard someone described as being house poor. What exactly does it mean? It is important to understand what it means to be house poor and how you can stay away from it.

There is a good chance you have heard someone described as being house poor. What exactly does it mean? It is important to understand what it means to be house poor and how you can stay away from it.

House Poor Means Spending A Significant Chunk Of Your Income On Housing

Being house-poor means different things for different people. In general, it means spending a significant amount of your monthly income on recurring expenses related to your house. A few examples include your mortgage, the interest on your mortgage, your property taxes, and HOA expenses. Owning a house can be expensive, and it is important for you to budget carefully. In general, you could not spend more than one-third of your monthly pay on your rent or your mortgage. If you are spending significantly more than this recommendation, you might qualify as house-poor.

How To Avoid Becoming House-Poor

Fortunately, there are several strategies you can follow if you want to avoid becoming house-poor. First, make sure you budget ahead of time. Understand exactly how much money you can spend on your home, and make every effort to stick to that number. Furthermore, before you purchase a house, make sure you get a home inspection completed. There are a lot of people who have their savings wiped out by unforeseen expenses. If you get an inspection before you buy a house, you can plan for those ahead of time. Finally, make sure you reduce your debt-to-income ratio before you buy a house. That way, you can qualify for the best home loan possible.

Do Not Spend More On Housing Than You Can Afford

In the end, it is critical for you to avoid spending more money on your house than you can afford. Remember that you should not spend more than one-third of your monthly pay on housing. If you do, your budget may be stretched thin and other areas, and you might have a difficult time covering other expenses. Do not hesitate to reach out to an expert who can help you find the right house for yourself and your family.

Jan 12, 2023 | Real Estate

After you have found the right house to meet your needs, you need to make the down payment to complete the transaction. Can you show up at the closing table with a suitcase full of cash? Of course, that would be a bit suspect, so that is not actually how it happens. What do you need to do to actually hand over the funds to buy the house?

After you have found the right house to meet your needs, you need to make the down payment to complete the transaction. Can you show up at the closing table with a suitcase full of cash? Of course, that would be a bit suspect, so that is not actually how it happens. What do you need to do to actually hand over the funds to buy the house?

The Down Payment Is Verified Beforehand

First, understand that the down payment is usually verified before you agree to the deal. Your real estate agent will work with you and the seller’s agent to ensure that you actually have the funds needed to buy the house. For example, you might need to send screenshots of your bank balance or investment portfolio as proof that you have the money. Your agent will work with you to ensure your confidential information remains so.

The Funds Are Typically Given Using A Wire Transfer

When it is time for you to complete the actual transaction, the real estate attorney will handle just about everything. The attorney will be responsible for collecting the money from the sale and ensuring that everyone gets the money they are owed. The attorney will provide you with the account information for where you need to wire the money. Prior to the closing date, you need to go to the bank and work with one of their experts to ensure the money is in your account and wired to the correct account destination.

The Real Estate Agent Will Confirm The Process Is Done

It is best not to wait until the last minute to wire the money into the account. Try to do this process ahead of time, and make sure either the attorney or your real estate agent says that the process has been completed. You do not want to run the risk of missing your closing date. If you have questions about the process, make sure you give the attorney’s office plenty of time to respond to you.

Determine Your Budget With The Help Of Your Real Estate Agent

This process is important for making sure you can afford the house you want. Work with your real estate agent to ensure you have the necessary funds for the down payment.

Jan 10, 2023 | Financial Reports, Housing Analysis, Real Estate

January 10, 2023 – Since the beginning of the pandemic, the housing market has experienced a series of highs and lows. The housing market was already strong prior to 2020, but the pandemic redefined the role of a home, creating a surge in demand which, coupled with record-low mortgage rates and limited housing supply, powered the housing market to multiple records during this unprecedented time – the fastest annual house price appreciation, the lowest days on market in the history of record-keeping, and a near-record annualized pace of sales. But, as mortgage rates increased alongside the Federal Reserve’s monetary policy tightening, the housing market froze up in the second half of 2022, with both buyers and sellers withdrawing from the market. Will the freeze continue well into 2023 or will the housing market begin to thaw?

demand which, coupled with record-low mortgage rates and limited housing supply, powered the housing market to multiple records during this unprecedented time – the fastest annual house price appreciation, the lowest days on market in the history of record-keeping, and a near-record annualized pace of sales. But, as mortgage rates increased alongside the Federal Reserve’s monetary policy tightening, the housing market froze up in the second half of 2022, with both buyers and sellers withdrawing from the market. Will the freeze continue well into 2023 or will the housing market begin to thaw?

“The main trend to watch is whether mortgage rates will go any higher and, if so, by how much.”

Three Scenarios for the 2023 Housing Market

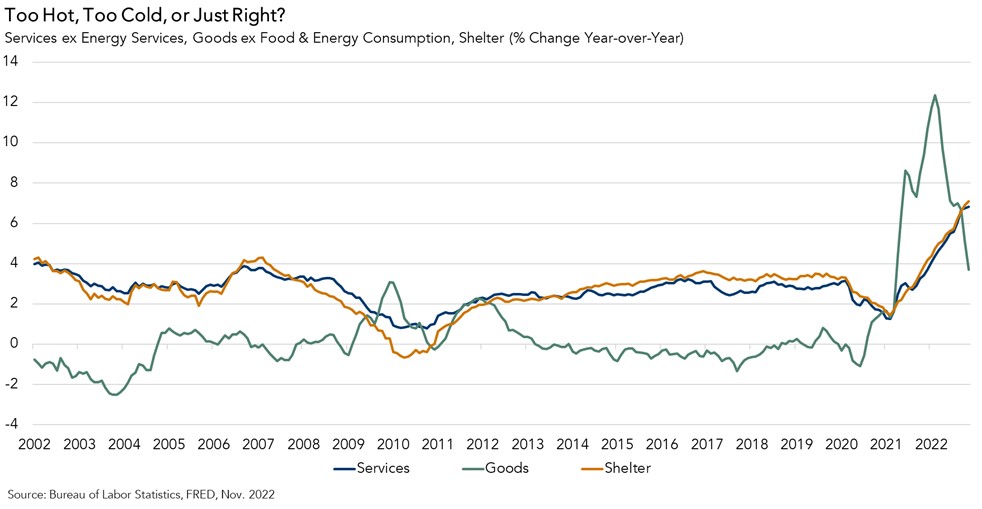

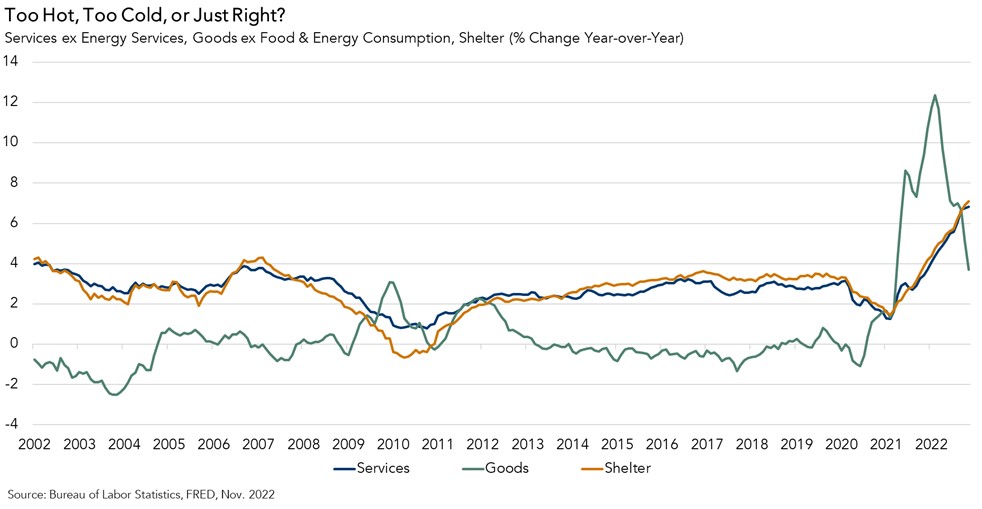

The popular 30-year, fixed mortgage rate is loosely benchmarked to the 10-year Treasury note, and when investors are concerned about inflation, their appetite for buying bonds diminishes, which puts upward pressure on bond yields and, therefore, mortgage rates. The risk is that rates will continue to increase until we get sustained evidence that inflation is receding. So, the outlook for the housing market is largely dependent on the path of inflation. Below are three possible paths for inflation that are anchored to the Fed’s monetary tightening: the baseline case (the likely), the downside case (the bad), and the upside case (the good).

- The Likely: The Fed is focused on the dynamics of inflation in parts, and not all parts are trending in the same direction. Core goods inflation increased dramatically in 2021 due to COVID-related supply disruptions and a demand surge for goods by domestic consumers. However, that inflation surge is now quickly fading.Service sector inflation is still rising, largely due to the shelter component. Shelter is considered a service and makes up 57 percent of core services in the Consumer Price Index. By virtue of how it is measured, shelter inflation also lags observed rental and house price increases by approximately one year. Rent and price growth are now decelerating, meaning the shelter component of inflation will cool – it’s just a matter of time.Core services excluding shelter is the last component. Service providers are still struggling to find labor, their primary input. As a result, service sector wages are still growing quickly – faster than the overall rate of wage growth, which is relatively strong itself. The Fed aims to lower consumption demand by setting the federal funds rate at just the right level. The “terminal rate”— the level at which the Fed is expected to stop raising interest rates — for the baseline case is approximately 5 to 5.25 percent, based on FOMC projections. If the Fed reaches this level by mid-2023, then they will likely hold rates at that higher level for the rest of the year.

As the Fed continues to tighten monetary policy, it will put more upward pressure on Treasury bonds and, therefore, mortgage rates in the first half of the year. Higher mortgage rates negatively impact both housing demand and supply, pricing out buyers who lose purchasing power and keeping some potential sellers rate-locked in. Prices will also continue to correct and reflect the new dynamic of less demand relative to slightly more, yet still well below historically normal, levels of supply. If inflation responds as expected in 2023 and the Fed’s terminal rate target is right, mortgage rates may start to decline as inflation expectations ease. Lower house prices and modestly lower mortgage rates would give house-buying power a boost.

- The Bad: The downside scenario reflects an economy that faces stubborn or even worsening inflation, leading the Fed to raise rates beyond the 5 to 5.25 percent terminal rate. This would lead to greater monetary tightness in the market and put even more upward pressure on mortgage rates, raising the probability of a recession. Even higher mortgage rates could further freeze the housing market, prompting even more sellers to stay put than in the base case due to the rate lock-in effect and buyers being further priced out of the market. In this scenario, we will see steeper price declines from the peak, both nationally and across a greater number of markets.

- The Good: The upside case is that the Fed doesn’t even need to raise rates to the 5 to 5.25 percent terminal rate because inflation comes down faster than expected. This scenario assumes consumers choose to pull back on spending, despite still sitting on a lot of excess savings built up during the pandemic. As a result, mortgage rates may stabilize sooner than in the base case, and potential buyers and sellers would benefit from the lack of rate volatility. Prices would continue to adjust in response to higher rates, which may provide an affordability boost to potential home buyers. But, even in this scenario, the housing market will still struggle from a lack of supply. Potential sellers would still be locked into record-low mortgage rates and hesitant to sell in a higher interest-rate environment.

What Do all Three Scenarios Have in Common?

In all three cases, the housing market will continue to rebalance as prices adjust to the reality of higher mortgage rates. However, the pace of price deceleration and the decline in home sales will be more severe in the downside, higher inflation scenario. The main trend to watch is whether mortgage rates will go any higher and, if so, by how much. Once mortgage rates peak, home sales volume and price declines will stabilize. That all depends on what the Fed chooses to do in the coming months and whether inflation begins to decline.

Credit: First American Title

Jan 10, 2023 | Real Estate

The whole idea of investing is to use a portion of your money now to get more down the road. It is important for everyone to diversify their investments, and you might be thinking about buying a second house to do so. Investing in real estate is a goal that a lot of people have, but how can you get started? It was challenging enough to buy your first house, so how can you afford a second one?

The whole idea of investing is to use a portion of your money now to get more down the road. It is important for everyone to diversify their investments, and you might be thinking about buying a second house to do so. Investing in real estate is a goal that a lot of people have, but how can you get started? It was challenging enough to buy your first house, so how can you afford a second one?

Use A Cash-Out Refinance To Buy Your Second House

One trick that many people overlook is that they can actually conduct a cash-out refinance to purchase a second house. In general, your lender will allow you to cash out up to 80 percent of the value of your home during a cash-out refinance. This can give you a tremendous amount of flexibility that you can use to purchase a second house. For example, if your house is worth $300,000, you may be able to withdraw tens of thousands of dollars in equity.

What To Consider When Using A Cash-Out Refinance

When you apply for a cash-out refinance, there is a chance that the interest rate on your new loan might change. This might mean that you end up with a higher interest rate than before. You must make sure you can afford this new interest rate. Furthermore, you will be required to pay closing expenses. You need to have enough money set aside to cover those closing expenses. Keep in mind that the term of the loan might change as well. If you were close to paying off your house, this type of refinance might reset that clock. It might take you longer to pay off your mortgage than it did before. Consider these factors carefully before conducting a cash-out refinance.

A Cash-Out Refinance Might Be Right For You

In the end, a cash-out refinance could be a great way for you to withdraw equity from your home, using it to purchase an investment property. On the other hand, you need to ensure you can still afford the new loan after you take that equity out of your home. Work with an expert who can help you find the right option to meet your needs.

demand which, coupled with record-low mortgage rates and limited housing supply, powered the housing market to multiple records during this unprecedented time – the fastest annual house price appreciation, the lowest days on market in the history of record-keeping, and a near-record annualized pace of sales. But, as mortgage rates increased alongside the Federal Reserve’s monetary policy tightening, the housing market froze up in the second half of 2022, with both buyers and sellers withdrawing from the market. Will the freeze continue well into 2023 or will the housing market begin to thaw?

demand which, coupled with record-low mortgage rates and limited housing supply, powered the housing market to multiple records during this unprecedented time – the fastest annual house price appreciation, the lowest days on market in the history of record-keeping, and a near-record annualized pace of sales. But, as mortgage rates increased alongside the Federal Reserve’s monetary policy tightening, the housing market froze up in the second half of 2022, with both buyers and sellers withdrawing from the market. Will the freeze continue well into 2023 or will the housing market begin to thaw?

Are you in the market for a new house? If so, you might be thinking about building your own house. It can be exciting to go through the process of building a house, as you will be in control of just about everything. On the other hand, how much is it going to cost you to build a house? You need to make sure you have an estimate before you decide to move forward with your project.

Are you in the market for a new house? If so, you might be thinking about building your own house. It can be exciting to go through the process of building a house, as you will be in control of just about everything. On the other hand, how much is it going to cost you to build a house? You need to make sure you have an estimate before you decide to move forward with your project.  Are you interested in purchasing a rental property? Instead of buying a new one, you might want to convert your primary residence into a rental property, particularly if you plan on moving in the near future. At the same time, you might think it is better to sell the property and take the cash instead. Which option is best for you?

Are you interested in purchasing a rental property? Instead of buying a new one, you might want to convert your primary residence into a rental property, particularly if you plan on moving in the near future. At the same time, you might think it is better to sell the property and take the cash instead. Which option is best for you? There is a good chance you have heard someone described as being house poor. What exactly does it mean? It is important to understand what it means to be house poor and how you can stay away from it.

There is a good chance you have heard someone described as being house poor. What exactly does it mean? It is important to understand what it means to be house poor and how you can stay away from it. After you have found the right house to meet your needs, you need to make the down payment to complete the transaction. Can you show up at the closing table with a suitcase full of cash? Of course, that would be a bit suspect, so that is not actually how it happens. What do you need to do to actually hand over the funds to buy the house?

After you have found the right house to meet your needs, you need to make the down payment to complete the transaction. Can you show up at the closing table with a suitcase full of cash? Of course, that would be a bit suspect, so that is not actually how it happens. What do you need to do to actually hand over the funds to buy the house?

The whole idea of investing is to use a portion of your money now to get more down the road. It is important for everyone to diversify their investments, and you might be thinking about buying a second house to do so. Investing in real estate is a goal that a lot of people have, but how can you get started? It was challenging enough to buy your first house, so how can you afford a second one?

The whole idea of investing is to use a portion of your money now to get more down the road. It is important for everyone to diversify their investments, and you might be thinking about buying a second house to do so. Investing in real estate is a goal that a lot of people have, but how can you get started? It was challenging enough to buy your first house, so how can you afford a second one?