Jan 17, 2023 | Financial Reports

Last week’s financial reporting was dominated by readings on inflation. Weekly reports on mortgage rates and jobless claims were also released and Treasury Secretary Janet Yellen cautioned lawmakers that the debt ceiling must be raised or eliminated.

Inflation slows in December

Month-to-month inflation slowed by -0.1 percent in December and matched analysts’ expectations. This was the first slowing of inflation since the pandemic and the highest inflation reading since inflation reached its highest level in 40 years. Inflation rose by 0.1 percent in November. Year-over-year inflation rose by 6.5 percent, which matched expectations, and fell short of the November reading of 7.1 percent inflation.

Consumer prices fell for the sixth consecutive month in December. Core inflation, which excludes volatile food and fuel sectors, rose by 0.3 percent in December and matched analysts’ expectations. Slowing inflation is expected, but the Federal Reserve has signaled its intention to continue raising its target interest rate range.

The University of Michigan projected that inflation will rise by 4.00 percent year-over-year in January as compared to December’s reading of 4.4 percent and the 40-year peak rate of 9.1 percent posted last summer.

Treasury Secretary: U.S. debt limit is looming

Treasury Secretary Janet Yellen announced that the U.S. debt ceiling is approaching and encouraged lawmakers to either raise or eliminate the debt ceiling to avoid the U.S. defaulting on its obligations. Ms. Yellen wrote in a letter to U.S. lawmakers, “While Treasury is not currently able to estimate how long extraordinary measures will enable us to continue to pay the government’s obligations, it’s unlikely that cash and extraordinary measures would be exhausted before early June.”

Ms. Yellen emphasized that increasing or removing the debt ceiling would not result in additional spending, but would allow the government to continue financing existing obligations made by lawmakers and Presidents of both parties. Secretary Yellen cautioned that failure to address the debt ceiling would “cause irreparable harm to the U.S. economy, the livelihoods of all Americans, and global financial stability.”

Mortgage Rates, Jobless Claims

Freddie Mac reported lower mortgage rates last week as the average rate for 30-year fixed-rate mortgages fell by 15 basis points to 6.33 percent. The average rate for 15-year fixed-rate mortgages fell by 21 basis points to 5.52 percent.

205,000 new jobless claims were filed last week, which fell short of projections for 210,000 initial claims filed and the previous week’s reading of 206,000 first-time claims filed. 1.63 million continuing jobless claims were filed as compared to the previous week’s reading of 1.70 million ongoing claims filed.

What’s Ahead

This week’s scheduled economic reports include readings from the National Association of Home Builders on housing markets, readings on housing starts, and building permits issued.

Jan 10, 2023 | Financial Reports, Housing Analysis, Real Estate

January 10, 2023 – Since the beginning of the pandemic, the housing market has experienced a series of highs and lows. The housing market was already strong prior to 2020, but the pandemic redefined the role of a home, creating a surge in demand which, coupled with record-low mortgage rates and limited housing supply, powered the housing market to multiple records during this unprecedented time – the fastest annual house price appreciation, the lowest days on market in the history of record-keeping, and a near-record annualized pace of sales. But, as mortgage rates increased alongside the Federal Reserve’s monetary policy tightening, the housing market froze up in the second half of 2022, with both buyers and sellers withdrawing from the market. Will the freeze continue well into 2023 or will the housing market begin to thaw?

demand which, coupled with record-low mortgage rates and limited housing supply, powered the housing market to multiple records during this unprecedented time – the fastest annual house price appreciation, the lowest days on market in the history of record-keeping, and a near-record annualized pace of sales. But, as mortgage rates increased alongside the Federal Reserve’s monetary policy tightening, the housing market froze up in the second half of 2022, with both buyers and sellers withdrawing from the market. Will the freeze continue well into 2023 or will the housing market begin to thaw?

“The main trend to watch is whether mortgage rates will go any higher and, if so, by how much.”

Three Scenarios for the 2023 Housing Market

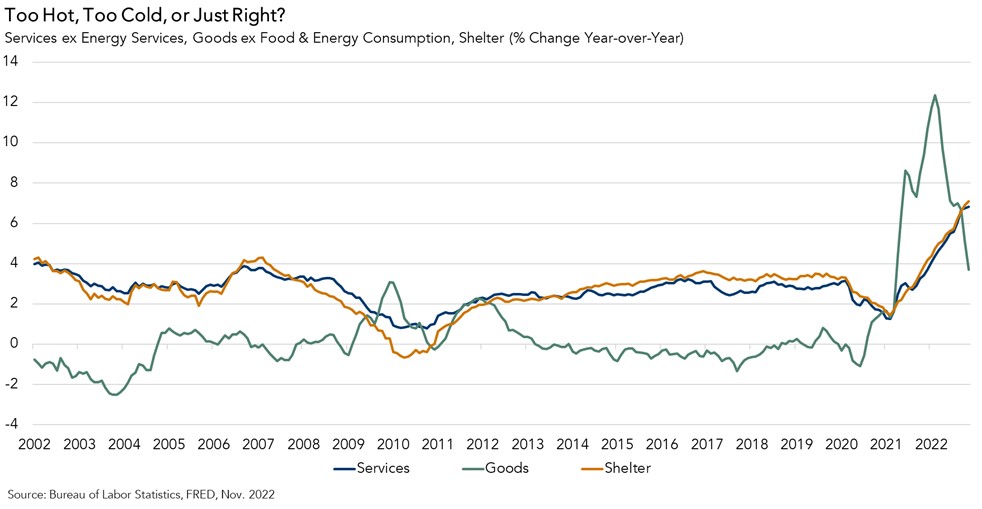

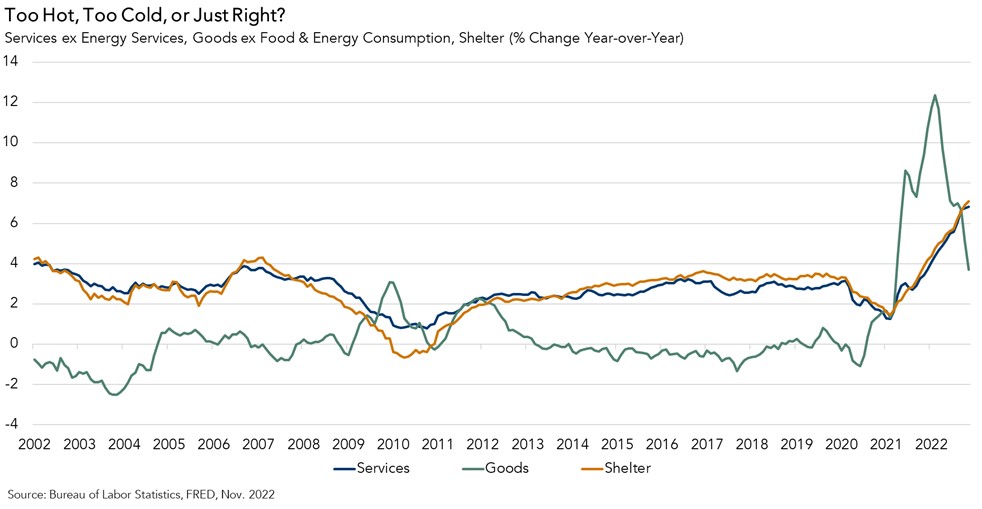

The popular 30-year, fixed mortgage rate is loosely benchmarked to the 10-year Treasury note, and when investors are concerned about inflation, their appetite for buying bonds diminishes, which puts upward pressure on bond yields and, therefore, mortgage rates. The risk is that rates will continue to increase until we get sustained evidence that inflation is receding. So, the outlook for the housing market is largely dependent on the path of inflation. Below are three possible paths for inflation that are anchored to the Fed’s monetary tightening: the baseline case (the likely), the downside case (the bad), and the upside case (the good).

- The Likely: The Fed is focused on the dynamics of inflation in parts, and not all parts are trending in the same direction. Core goods inflation increased dramatically in 2021 due to COVID-related supply disruptions and a demand surge for goods by domestic consumers. However, that inflation surge is now quickly fading.Service sector inflation is still rising, largely due to the shelter component. Shelter is considered a service and makes up 57 percent of core services in the Consumer Price Index. By virtue of how it is measured, shelter inflation also lags observed rental and house price increases by approximately one year. Rent and price growth are now decelerating, meaning the shelter component of inflation will cool – it’s just a matter of time.Core services excluding shelter is the last component. Service providers are still struggling to find labor, their primary input. As a result, service sector wages are still growing quickly – faster than the overall rate of wage growth, which is relatively strong itself. The Fed aims to lower consumption demand by setting the federal funds rate at just the right level. The “terminal rate”— the level at which the Fed is expected to stop raising interest rates — for the baseline case is approximately 5 to 5.25 percent, based on FOMC projections. If the Fed reaches this level by mid-2023, then they will likely hold rates at that higher level for the rest of the year.

As the Fed continues to tighten monetary policy, it will put more upward pressure on Treasury bonds and, therefore, mortgage rates in the first half of the year. Higher mortgage rates negatively impact both housing demand and supply, pricing out buyers who lose purchasing power and keeping some potential sellers rate-locked in. Prices will also continue to correct and reflect the new dynamic of less demand relative to slightly more, yet still well below historically normal, levels of supply. If inflation responds as expected in 2023 and the Fed’s terminal rate target is right, mortgage rates may start to decline as inflation expectations ease. Lower house prices and modestly lower mortgage rates would give house-buying power a boost.

- The Bad: The downside scenario reflects an economy that faces stubborn or even worsening inflation, leading the Fed to raise rates beyond the 5 to 5.25 percent terminal rate. This would lead to greater monetary tightness in the market and put even more upward pressure on mortgage rates, raising the probability of a recession. Even higher mortgage rates could further freeze the housing market, prompting even more sellers to stay put than in the base case due to the rate lock-in effect and buyers being further priced out of the market. In this scenario, we will see steeper price declines from the peak, both nationally and across a greater number of markets.

- The Good: The upside case is that the Fed doesn’t even need to raise rates to the 5 to 5.25 percent terminal rate because inflation comes down faster than expected. This scenario assumes consumers choose to pull back on spending, despite still sitting on a lot of excess savings built up during the pandemic. As a result, mortgage rates may stabilize sooner than in the base case, and potential buyers and sellers would benefit from the lack of rate volatility. Prices would continue to adjust in response to higher rates, which may provide an affordability boost to potential home buyers. But, even in this scenario, the housing market will still struggle from a lack of supply. Potential sellers would still be locked into record-low mortgage rates and hesitant to sell in a higher interest-rate environment.

What Do all Three Scenarios Have in Common?

In all three cases, the housing market will continue to rebalance as prices adjust to the reality of higher mortgage rates. However, the pace of price deceleration and the decline in home sales will be more severe in the downside, higher inflation scenario. The main trend to watch is whether mortgage rates will go any higher and, if so, by how much. Once mortgage rates peak, home sales volume and price declines will stabilize. That all depends on what the Fed chooses to do in the coming months and whether inflation begins to decline.

Credit: First American Title

Jan 9, 2023 | Financial Reports

Last week’s economic reporting included readings on minutes of the most recent Federal Open Market Committee meeting and its customary post-meeting press conference, labor-sector data on public and private-sector jobs, and the national unemployment rate. Weekly readings on mortgage rates and jobless claims were also released.

Last week’s economic reporting included readings on minutes of the most recent Federal Open Market Committee meeting and its customary post-meeting press conference, labor-sector data on public and private-sector jobs, and the national unemployment rate. Weekly readings on mortgage rates and jobless claims were also released.

FOMC Meeting: Policymakers seek a balance between high inflation and rising rates

The minutes of the Federal Open Market Committee meeting held on December 13 and 14 reflect committee members’ concern over controlling rapidly growing inflation while avoiding a recession. While committee members said that they made “significant progress” in raising rates to cut inflation, members said they needed to avoid raising rates too fast and creating a recession. Policymakers asked for “flexibility” from investors and consumers.

The Fed’s monetary policy actions depend on economic developments; if high inflation persists, policymakers will likely continue raising the Fed’s target interest rate range. If inflation eases, so will the Fed’s pace of raising its target interest rate range. The Fed re-asserted its goal of achieving two percent inflationary growth. The meeting minutes emphasized that the Committee’s decision to slow the pace of interest rate growth did not indicate any changes to the Fed’s goal of two percent inflation.

Mortgage rates rise, jobless claims fall

Freddie Mac reported higher mortgage rates last week as the average rate for 30-year fixed-rate mortgages rose by six basis points to 6.48 percent. The average rate for 15-year fixed-rate mortgages was five basis points higher at 5.73 percent.

204,000 new jobless claims were filed last week, which fell short of the expected reading of 223,000 initial claims filed and the previous week’s reading, also of 223,000 first-time claims filed. Continuing jobless claims fell to 1.69 million claims filed as compared to the previous week’s reading of 1.72 million ongoing claims filed.

The national unemployment rate fell to 3.5 percent in December as compared to 3.6 percent n November and the expected unemployment rate of 3.7 percent.

What’s Ahead

This week’s scheduled economic reporting includes readings on month-to-month and year-over-year inflation and weekly readings on mortgage rates and jobless claims.

Jan 9, 2023 | Financial Reports

Last week’s economic reporting included readings on minutes of the most recent Federal Open Market Committee meeting and its customary post-meeting press conference, labor-sector data on public and private-sector jobs, and the national unemployment rate. Weekly readings on mortgage rates and jobless claims were also released.

Last week’s economic reporting included readings on minutes of the most recent Federal Open Market Committee meeting and its customary post-meeting press conference, labor-sector data on public and private-sector jobs, and the national unemployment rate. Weekly readings on mortgage rates and jobless claims were also released.

FOMC Meeting: Policymakers seek a balance between high inflation and rising rates

The minutes of the Federal Open Market Committee meeting held on December 13 and 14 reflect committee members’ concern over controlling rapidly growing inflation while avoiding a recession. While committee members said that they made “significant progress” in raising rates to cut inflation, members said they needed to avoid raising rates too fast and creating a recession. Policymakers asked for “flexibility” from investors and consumers.

The Fed’s monetary policy actions depend on economic developments; if high inflation persists, policymakers will likely continue raising the Fed’s target interest rate range. If inflation eases, so will the Fed’s pace of raising its target interest rate range. The Fed re-asserted its goal of achieving two percent inflationary growth. The meeting minutes emphasized that the Committee’s decision to slow the pace of interest rate growth did not indicate any changes to the Fed’s goal of two percent inflation.

Mortgage rates rise, jobless claims fall

Freddie Mac reported higher mortgage rates last week as the average rate for 30-year fixed-rate mortgages rose by six basis points to 6.48 percent. The average rate for 15-year fixed-rate mortgages was five basis points higher at 5.73 percent.

204,000 new jobless claims were filed last week, which fell short of the expected reading of 223,000 initial claims filed and the previous week’s reading, also of 223,000 first-time claims filed. Continuing jobless claims fell to 1.69 million claims filed as compared to the previous week’s reading of 1.72 million ongoing claims filed.

The national unemployment rate fell to 3.5 percent in December as compared to 3.6 percent n November and the expected unemployment rate of 3.7 percent.

What’s Ahead

This week’s scheduled economic reporting includes readings on month-to-month and year-over-year inflation and weekly readings on mortgage rates and jobless claims.

Jan 2, 2023 | Financial Reports

Last week’s economic reporting included readings on U.S. housing markets, pending home sales, and weekly readings on mortgage rates and jobless claims.

Last week’s economic reporting included readings on U.S. housing markets, pending home sales, and weekly readings on mortgage rates and jobless claims.

S&P Case Shiller Home Price Indices: Month-to-moth home prices fall in October

U.S. home prices fell in October for the fourth consecutive month. Wavering demand for homes was caused by rising mortgage rates and high home prices in many regional markets. The 20-City home price index showed the top three cities with the highest month-to-month home price declines were Miami. Florida with a -1.0 percent decline, Tampa, Florida where home prices declined by -0,8 percent, and Charlotte, North Carolina where home prices dropped by -0.9 percent month-to-month in October.

Year-over-year home prices rose by 21 percent in Miami, Florida; year-over-year home prices rose by 20.5 percent in Tampa, Florida. Charlotte, North Carolina reported a year-over-year home price gain of 15.0 percent as of October.

The Federal Housing Finance Agency reported that home price growth was flat from September to October as compared to a month-to-month gain of 0.10 percent in September. Analysts said that high home prices and mortgage rates have decreased demand for homes as would-be buyers face affordability issues and strict mortgage credit requirements.

Mortgage Rates Mixed, Jobless Claims Rise

Freddie Mac reported higher fixed mortgage rates last week as the average rate for 30-year fixed-rate mortgages rose by 15 basis points to 6.42 percent. Rates for 15-year fixed-rate mortgages fell by one basis point to an average of 5.68 percent.

New jobless claims rose last week to 225,000 initial claims filed as compared to 216,000 initial claims filed in the previous week. Analysts expected a reading of 223,000 first-time jobless claims filed. Ongoing jobless claims rose last week with 1.71 million continuing jobless claims filed as compared to 1.67 million continuing jobless claims filed in the previous week.

What’s Ahead

This week’s scheduled economic news includes readings on construction spending, minutes of the most recent Federal Open Market Committee meeting, and public and private-sector jobs data. Weekly reports on mortgage rates and jobless claims will also be released.

Dec 26, 2022 | Financial Reports

Last week’s economic scheduled economic news included readings on sales of previously-owned homes, housing starts, and building permits issued. Readings on the Consumer Price Index, which tracks inflation, were also released along with weekly readings on mortgage rates and jobless claims.

Last week’s economic scheduled economic news included readings on sales of previously-owned homes, housing starts, and building permits issued. Readings on the Consumer Price Index, which tracks inflation, were also released along with weekly readings on mortgage rates and jobless claims.

Sales of previously-owned homes fall in November

The National Association of Realtors® reported fewer sales of previously-owned homes in November than in October. 4.09 million previously-owned homes were sold year-over-year in November as compared to 4.43 million sales reported in October. This was the tenth consecutive month showing fewer sales of previously-owned homes. Although mortgage rates and home prices have eased recently, it will take additional time for would-be buyers to adjust their budgets during and after the winter holiday season.

The Commerce Department reported 1.34 million building permits issued in November; analysts expected a reading of 1.48 million permits issued as compared to October’s reading of 1.51 million permits issued. The onset of winter weather typically impacts building permits issued and rising concerns about inflation and recession also sidelined home builders who took a “wait-and-see” position about current economic conditions.

Housing starts were unchanged in November with 1.43 million housing starts reported on a seasonally-adjusted annual basis. Analysts expected a reading of 1.40 million starts in November.

Mortgage Rates. Inflation, and Jobless Claims

Freddie Mac reported mixed readings for average mortgage rates last week as the average for 30-year fixed-rate mortgages fell by four basis points to 6.27 percent. The average rate for 15-year fixed-rate mortgages rose by 15 basis points to 5.69 percent.

Month-to-month inflation rose by 0.10 percent in November as compared to an increase of 0.40 percent in October. The average rate for 15-year fixed-rate mortgages rose by 15 basis points to 5.69 percent.

Core inflation, which excludes volatile food and fuel sectors, rose by 0.20 percent as compared to October’s month-to-month increase of 0.30 percent. Year-over-year inflation rose by 5.50 percent in November as compared to October’s year-over-year inflation rate of 6.10 percent.

216,000 first-time jobless claims were filed last week, which fell short of the expected reading of 220,000 initial claims filed but surpassed the prior week’s reading of 214,000 new jobless claims filed. The final consumer sentiment report for December showed an index reading of 59.7 as compared to the expected reading of 59.1 and November’s index reading of 59.1.

What’s Ahead

This week’s scheduled economic reporting includes readings on U.S. housing markets, pending home sales, and weekly readings on mortgage rates and jobless claims.

demand which, coupled with record-low mortgage rates and limited housing supply, powered the housing market to multiple records during this unprecedented time – the fastest annual house price appreciation, the lowest days on market in the history of record-keeping, and a near-record annualized pace of sales. But, as mortgage rates increased alongside the Federal Reserve’s monetary policy tightening, the housing market froze up in the second half of 2022, with both buyers and sellers withdrawing from the market. Will the freeze continue well into 2023 or will the housing market begin to thaw?

demand which, coupled with record-low mortgage rates and limited housing supply, powered the housing market to multiple records during this unprecedented time – the fastest annual house price appreciation, the lowest days on market in the history of record-keeping, and a near-record annualized pace of sales. But, as mortgage rates increased alongside the Federal Reserve’s monetary policy tightening, the housing market froze up in the second half of 2022, with both buyers and sellers withdrawing from the market. Will the freeze continue well into 2023 or will the housing market begin to thaw?

Last week’s economic reporting included readings on minutes of the most recent Federal Open Market Committee meeting and its customary post-meeting press conference, labor-sector data on public and private-sector jobs, and the national unemployment rate. Weekly readings on mortgage rates and jobless claims were also released.

Last week’s economic reporting included readings on minutes of the most recent Federal Open Market Committee meeting and its customary post-meeting press conference, labor-sector data on public and private-sector jobs, and the national unemployment rate. Weekly readings on mortgage rates and jobless claims were also released. Last week’s economic scheduled economic news included readings on sales of previously-owned homes, housing starts, and building permits issued. Readings on the Consumer Price Index, which tracks inflation, were also released along with weekly readings on mortgage rates and jobless claims.

Last week’s economic scheduled economic news included readings on sales of previously-owned homes, housing starts, and building permits issued. Readings on the Consumer Price Index, which tracks inflation, were also released along with weekly readings on mortgage rates and jobless claims.