SUMMARY: Starting March 1, 2026, FinCEN’s Residential Real Estate Rule requires a Real Estate Report for certain non-financed residential transfers where the buyer is an entity or trust (common “cash/opaque ownership” scenarios). Real estate agents do not file the...

What Real Estate Agents Need to Know About FinCEN’s New Residential Real Estate Reporting Rule (Effective March 1, 2026)

FinCEN’s New Residential Real Estate Reporting Rule (Effective March 1, 2026)

What Real Estate Agents Need to KnowSUMMARY: Starting March 1, 2026, FinCEN’s Residential Real Estate Rule requires a Real Estate Report for certain non-financed residential transfers where the buyer is an entity or trust (common “cash/opaque ownership” scenarios). Real estate agents do not file the report—the closing/settlement side determines the “reporting person” using FinCEN’s reporting cascade (often the closing/settlement agent or the person who prepares the settlement statement). Expect more buyer identity/beneficial ownership questions earlier in the transaction for covered deals.

A major new federal reporting requirement is about to change certain residential real estate closings—especially the kinds of deals where ownership is purchased through an LLC or trust and the transaction is not financed through a traditional, AML-regulated lender. Beginning March 1, 2026, FinCEN (the Financial Crimes Enforcement Network, U.S. Treasury) will require a Real Estate Report to be filed for qualifying transfers.

This is designed to reduce the use of U.S. residential real estate for illicit finance by increasing transparency around who ultimately owns/controls the purchasing entity or trust in certain higher-risk, non-financed transactions.

1) Who this applies to (and who it usually doesn’t)

Typically in scope

The rule targets non-financed transfers of residential real property to a transferee entity (e.g., LLC/corporation/partnership/estate/association) or a transferee trust (most trusts and similar arrangements, with some exemptions).

Typically not in scope

A transaction is not “non-financed” (and therefore generally not reportable under this rule) if it includes credit that is:

- secured by the property, and

- extended by a financial institution that is subject to AML program requirements and SAR filing obligations.

That’s why many “normal” mortgage closings are generally outside this specific reporting rule—while all-cash, private financing, or certain lender situations can fall into the reportable bucket. FinCEN also states that financing by a lender without AML/SAR obligations is treated as non-financed for this rule (meaning it can be reportable).

2) What counts as “residential real property” here

FinCEN’s definition includes single-family homes, townhouses, condos, co-ops, and buildings designed for occupancy by 1–4 families, including certain mixed-use situations and certain land intended for construction of a 1–4 family residence.

3) What triggers a Real Estate Report

A Real Estate Report is required for a “reportable transfer,” defined as:

- a non-financed transfer

- to a transferee entity or transferee trust

- of an ownership interest in residential real property.

FinCEN’s FAQ also clarifies that a “transfer” includes not only purchases, but can include transfers for no consideration (like gifts) if they meet the rule’s criteria.

There are specific categories of transfers that are not reportable (examples include certain transfers due to death, divorce, bankruptcy, court supervision, certain no-consideration transfers to grantor/settlor trusts, 1031 qualified intermediary transfers, etc.).

4) Who files the report (this is key for agents)

Only one party is the “reporting person.” FinCEN identifies the reporting person using either:

- the reporting cascade, or

- a written designation agreement between eligible parties in the cascade.

The reporting cascade (high-level)

FinCEN’s cascade starts with:

- the person listed as the closing/settlement agent on the closing/settlement statement, then

- the person who prepares the closing/settlement statement, then additional steps if those don’t apply.

FinCEN’s filing instructions also emphasize that the reporting person is determined through the reporting cascade or a designation agreement, and that the reporting person remains responsible for complete and timely filing (even if they outsource the preparation).

Bottom line for Real Estate Agents: you are part of the transaction workflow, but the report filing responsibility is handled on the closing/settlement side (often the settlement agent/closing attorney role, depending on the transaction and how the cascade lands).

5) What information gets collected (what your entity/trust buyers will notice)

FinCEN states the reporting person must submit information sufficient to identify:

- the reporting person,

- the property,

- the transferor (seller),

- the transferee entity/trust (buyer),

- the individuals representing the transferee, and

- the beneficial owners of the transferee entity/trust.

FinCEN gives examples of beneficial owner identifying data that must be collected, including: name, date of birth, residential address, citizenship, and taxpayer identification number.

6) Timing: when reports are due (and what “March 1” really means)

FinCEN’s guidance is explicit:

- No reports are required for transfers that close prior to March 1, 2026.

- For reportable transfers, the report must be filed by the later of:

- the last day of the month following the month of closing, or

- 30 calendar days after closing.

FinCEN also notes this generally gives reporting persons about 30–60 days to file.

Reports are filed electronically through FinCEN’s BSA E-Filing System (the Residential Real Estate Rule page points filers to BSA E-Filing beginning March 1, 2026).

7) What agents should expect (without making agents “responsible”)

Even when agents are not the filer, this rule can affect your timeline and client experience in certain deals. Here’s what will realistically change for covered transactions:

- Entity/trust buyers may be asked earlier for ownership/beneficial owner information and certifications.

- There may be more back-and-forth between the buyer and the settlement team if beneficial ownership details are incomplete or unclear.

- Covered transactions may need a little more lead time so documentation doesn’t bottleneck the closing. (This is a workflow implication of the required data and filing obligation, not a new duty placed on agents.)

Practical agent takeaway: if your buyer is purchasing through an LLC or trust and isn’t using a traditional AML/SAR-regulated lender, it’s smart to flag that early to the settlement team so they can confirm whether the transfer is reportable and begin collecting what’s needed.

8) Recordkeeping (for the reporting person)

FinCEN states the reporting person must retain:

- the beneficial ownership certification from the transferee (or representative), and

any designation agreement,

for five years. FinCEN also states the reporting person is not required to retain a copy of the Real Estate Report itself.

9) A quick note on penalties (high level)

FinCEN’s FAQs focus on the reporting framework and do not lay out a simple penalty schedule on the FAQ page itself. In general, FinCEN reporting regimes are backed by civil and criminal enforcement mechanisms under federal law, which is why settlement teams are building formal intake and documentation workflows for reportable transfers.

Example secondary sources discussing civil/criminal exposure:

REFERENCES:

- FinCEN Residential Real Estate Rule hub: https://www.fincen.gov/rre

- FinCEN Residential Real Estate FAQs: https://www.fincen.gov/rre-faqs

- FinCEN Real Estate Report – Filing Instructions (PDF): https://www.fincen.gov/system/files/2025-12/RRE-Filing-Instructions.pdf

- FinCEN postponement news release (to March 1, 2026): https://www.fincen.gov/news/news-releases/fincen-announces-postponement-residential-real-estate-reporting-until-march-1

Providing title, escrow, closing and settlement services to clients throughout Massachusetts and New Hampshire

Recent News

What Real Estate Agents Need to Know About FinCEN’s New Residential Real Estate Reporting Rule (Effective March 1, 2026)

Why New Homeowners Get Targeted After Closing

For many buyers, one of the most surprising parts of homeownership happens after the closing is complete: the sudden increase in mail related to their property. This isn’t accidental—and it isn’t unique to any one company or offer. It’s the predictable result of how...

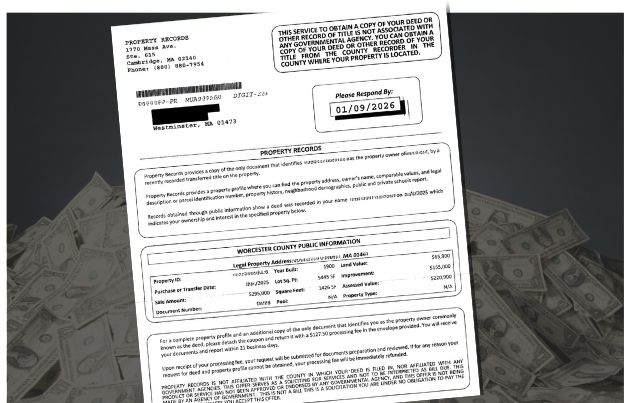

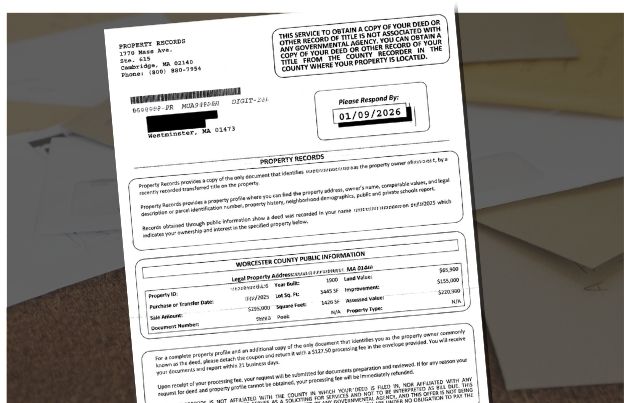

New Homeowners Beware: “Recorded Deed” Letters That Aren’t What They Seem

Buying your first home is exciting—and it often comes with a mountain of paperwork. Unfortunately, it can also make you a target for misleading solicitations that appear official and urgent, but offer nothing you actually need.One of the most common examples we see...